First home owners hub.

Finance.

FAQs.

What are the steps involved in building my first home?

A preliminary chat

First, we’ll talk about what you’re looking for in a first home – now, and in the future. We’ll also discuss where you’d like to live.

Finding finance

You might have already sorted your finance. If not, you can utilise our expert finance partners at Charter Private.

Signing the contract

This is where it starts to feel real!

Choose your palette

Select colour schemes, design the interior, change your mind at least four times…

The build begins

mayde will get to work building your home.

Walkthrough

Once the construction’s complete, we’ll walk you through to make sure everything’s just how you imagined it.

Home, sweet, snug, comfortable home

This is where you find your plants a spot in the sun, hang your favourite pictures on the walls, and add your new keys to your keychain.

Aftercare

We won’t ghost you once the keys are handed over. In fact, we’re here if anything pops up during the aftercare period.

What government incentives are available?

Buying your first home is no small feat (and certainly not a cheap one). Thankfully, there are a range of government incentives to help make this happen sooner.

Our finance partner, Charter Private, can help work out what’s available for you.

Get in touch with us to organise a chat with Charter Private.

What is Stamp duty?

Stamp duty is a tax the government applies to certain transactions, like the purchase of a property. The amount changes depending on all sorts of factors. Some include the property’s value, its location and whether you’re a first-home owner.

In Australia, stamp duty is state-based, so each state and territory has its own rates and rules. Sometimes there are exemptions or concessions for first-home buyers or off-the-plan purchases (good point to note: all mayde properties are purchased off-the-plan).

Overall, stamp duty can be a significant upfront cost that you’ll need to factor into your budget when purchasing property.

Who is Charter Private?

Charter Private is the best team of mortgage brokers in town. They negotiate to get the best possible home loan to suit your needs and will help you navigate the complexities of all things property finance. And with their 20+ years of finance experience and 1,000+ happy clients – and counting – we’re proud as punch to partner with them.

How do I know what I can afford?

Income, expenses, savings and what you had for breakfast all affect your borrowing capacity. Well, the first three factors at least.

Part of the process at mayde includes working out your affordability before committing to a purchase.

If you’re happy with a rough guide, visit the borrowing calculators we’ve produced alongside Charter Private.

Looking for something more precise? Get an accurate estimate with a free, zero-obligation finance check.

If you’re not quite ready for finance chats yet, we also offer structured savings plans. mayde’s dream is to help everyone get into their own home, not just those cashed up and ready to go today.

How much of a deposit do I need to build my first home?

To go from the sale to signing the contract, mayde requires an initial deposit of $2,000. From there, sorry to answer like a politician, but it depends.

Sometimes the deposit can be negotiated. Other times, the bank or lending institution requires you to have a certain amount ready for when the build starts. In most cases, a minimum deposit of 10% of the home’s purchase price is required, but you may also be eligible to pay a 5% deposit.

Get in touch with us for a more solid (and less politician-y) answer.

What is the difference between a bank and a broker?

A bank will only ever present you with their own products, whereas a broker will go to many banks and lending institutions to find the best fit for you.

Banks may offer a limited range of options, meaning you’ve got less flexibility. On the other hand, mortgage brokers can access a variety of mortgage products from multiple financial institutions. Choosing to work with them gives you wider access to more loan options, personalised service and expert guidance. They can help you navigate complexities and find the best mortgage product to fit your goals and financial situation.

Charter Private is our brokering partner, but that doesn’t stop you from bringing your own broker or heading straight to your own bank. You can still build with mayde, obstacle-free.

What’s the benefit of building over buying an existing property?

There’s nothing quite like that new car smell, is there? Imagine that feeling ten-fold when you’re the first one in your brand-new home. It’s all yours. The floorplan, colour choices, layout, fixtures. But that’s not all…

Building provides you with a warranty on your place, as well as a structural guarantee.

If you’re still working towards a deposit, building also gives you more time to save.

Then there’s fancy words like ‘capital appreciation’, which basically means you’re improving what was empty land.

And new estates are often surrounded by lots of fresh, sparkling amenities. Think parks, running tracks, schools, shopping centres and more.

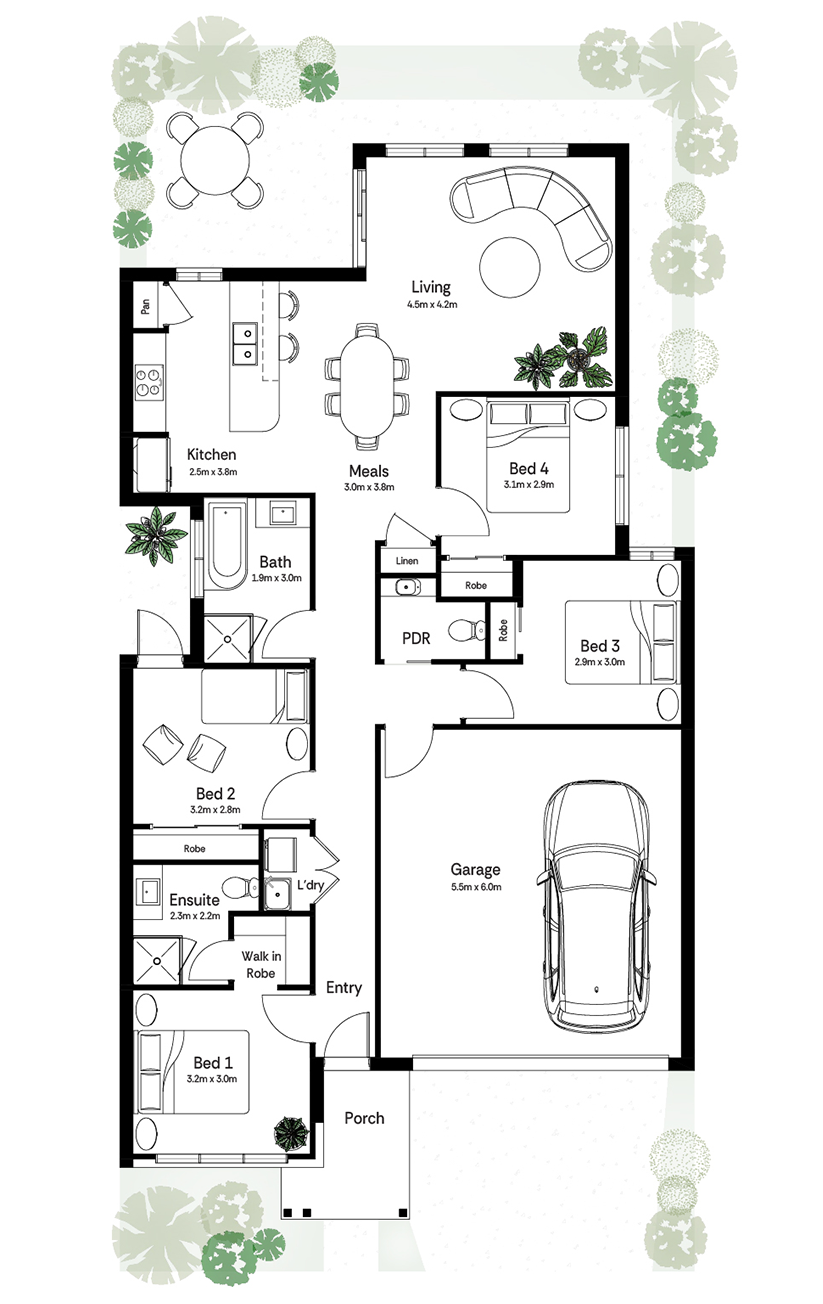

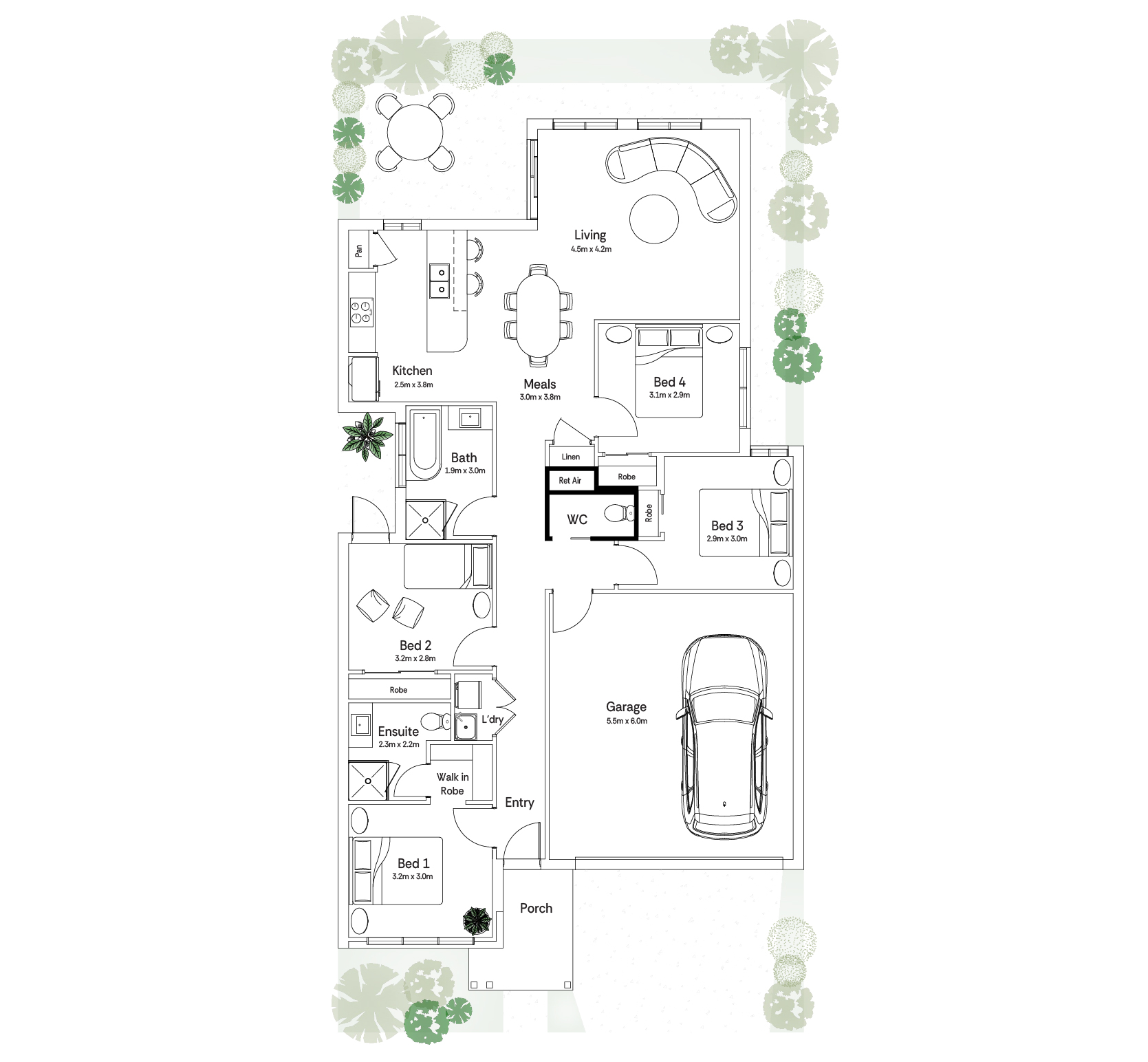

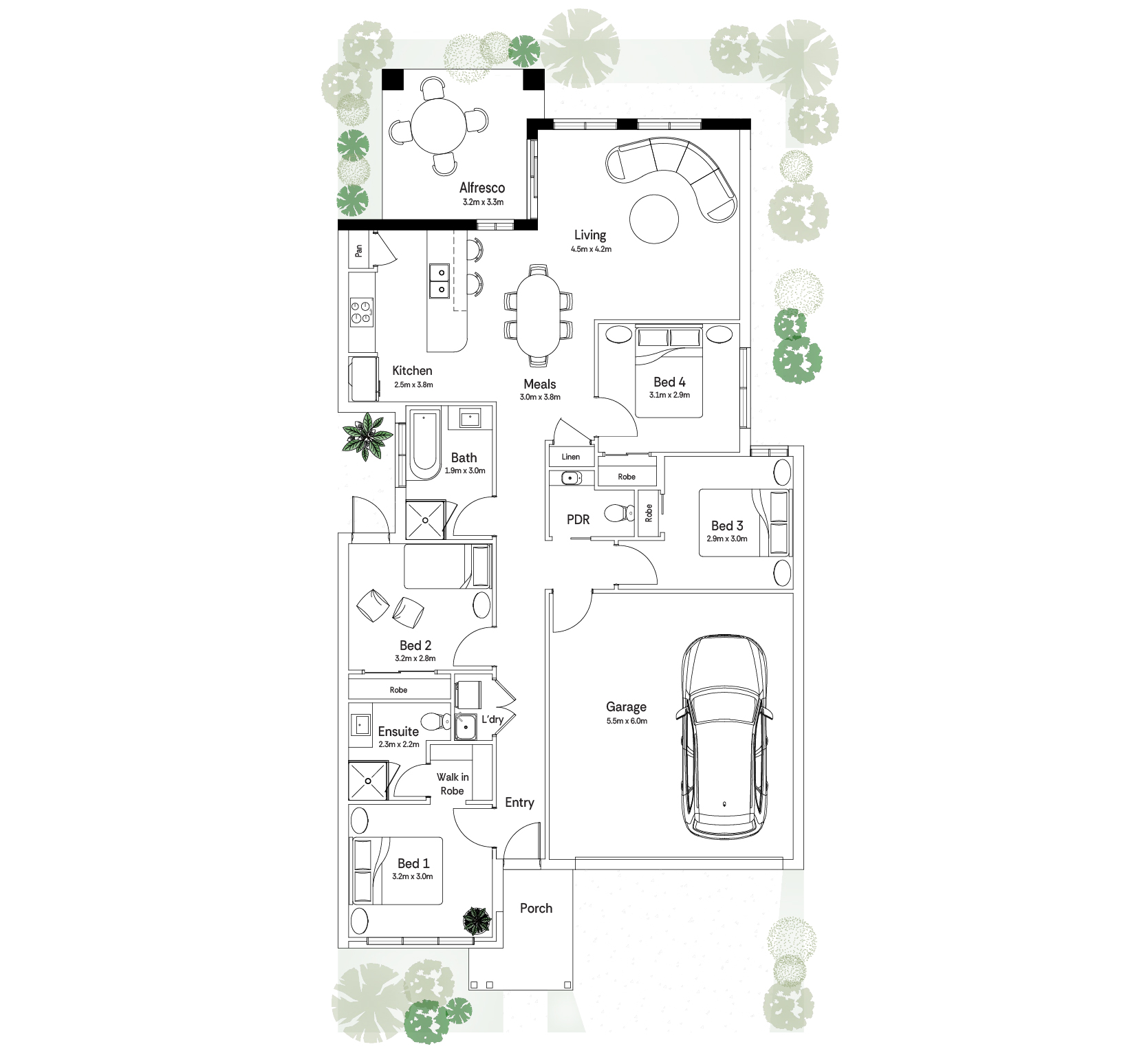

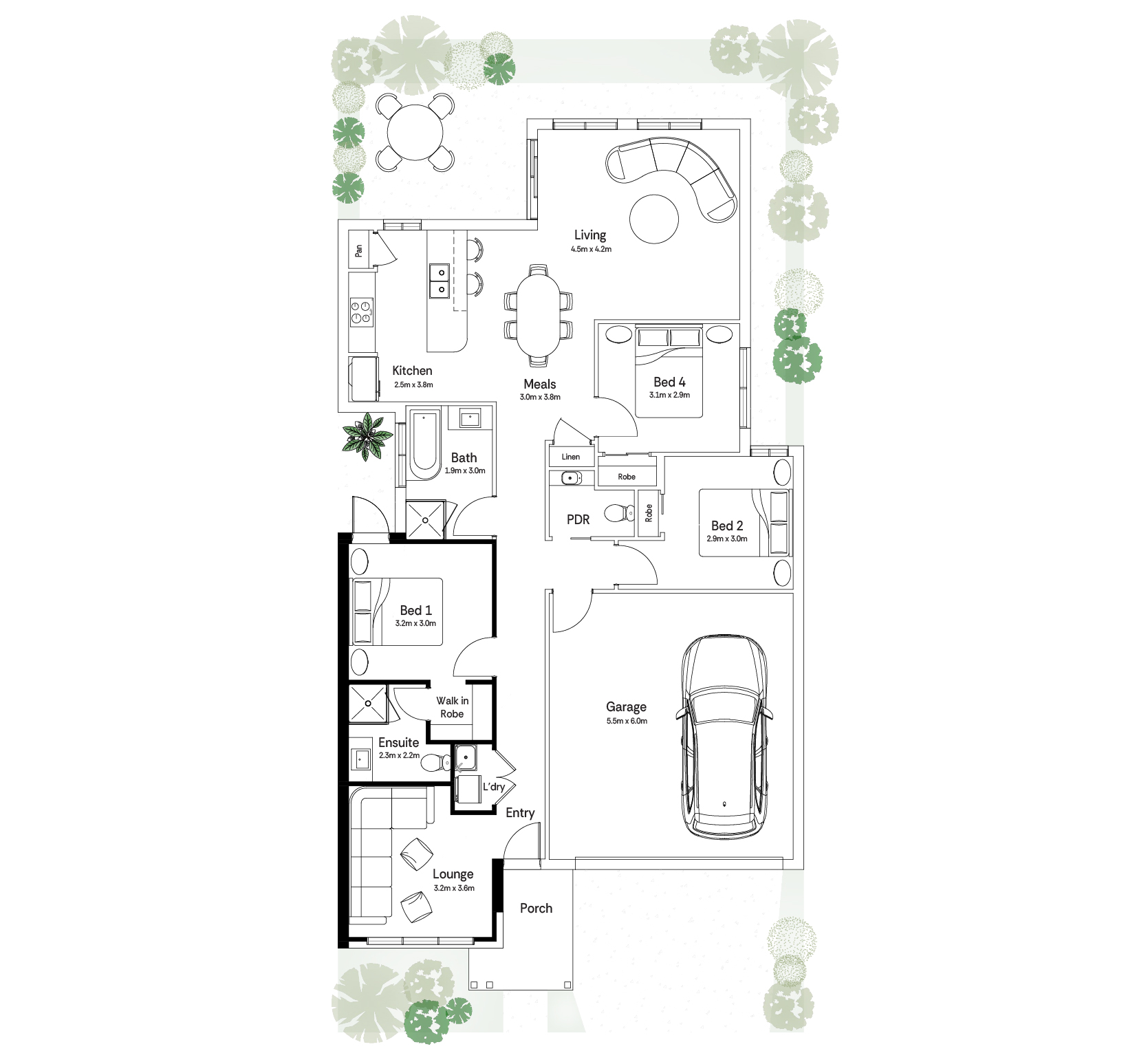

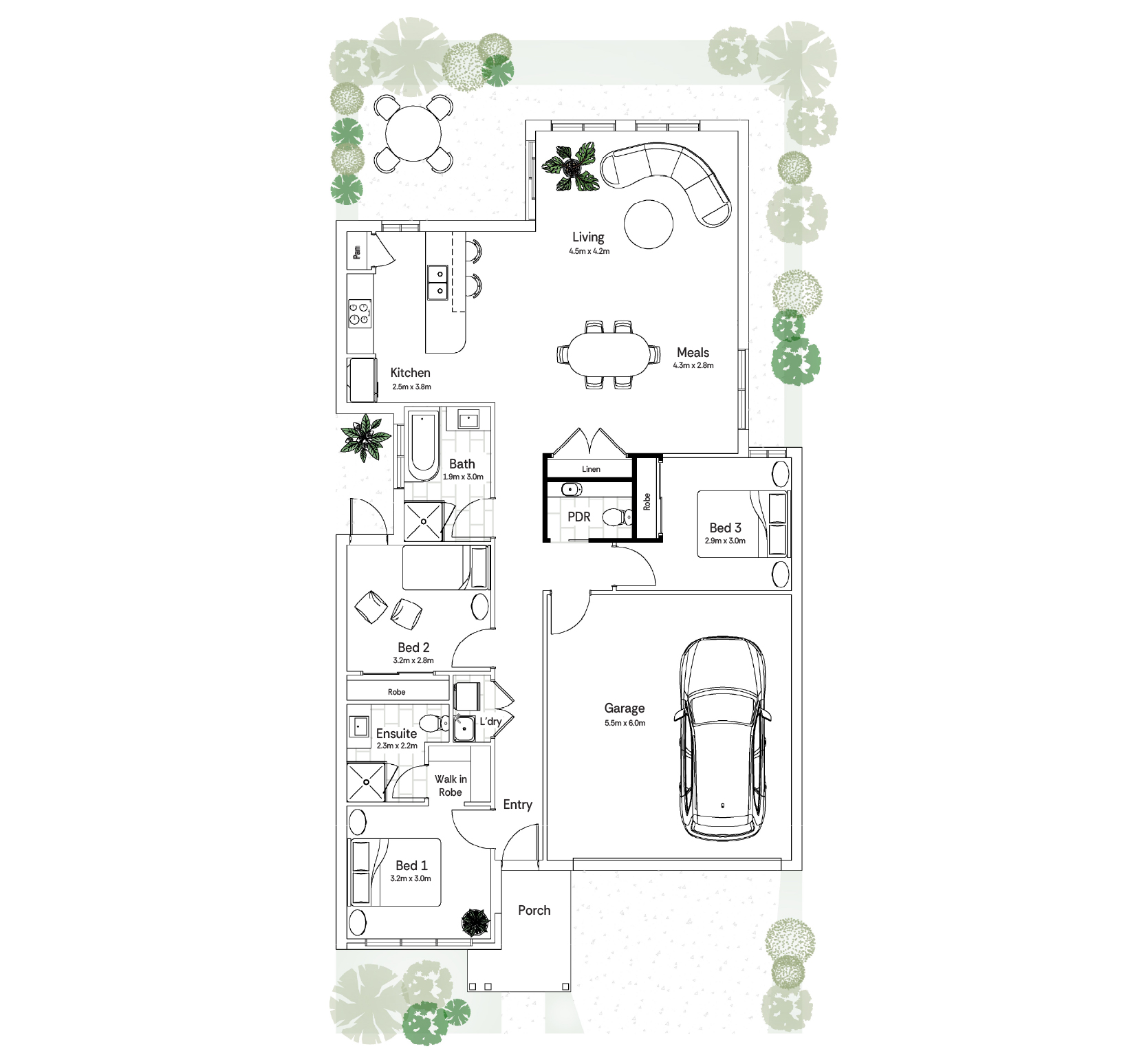

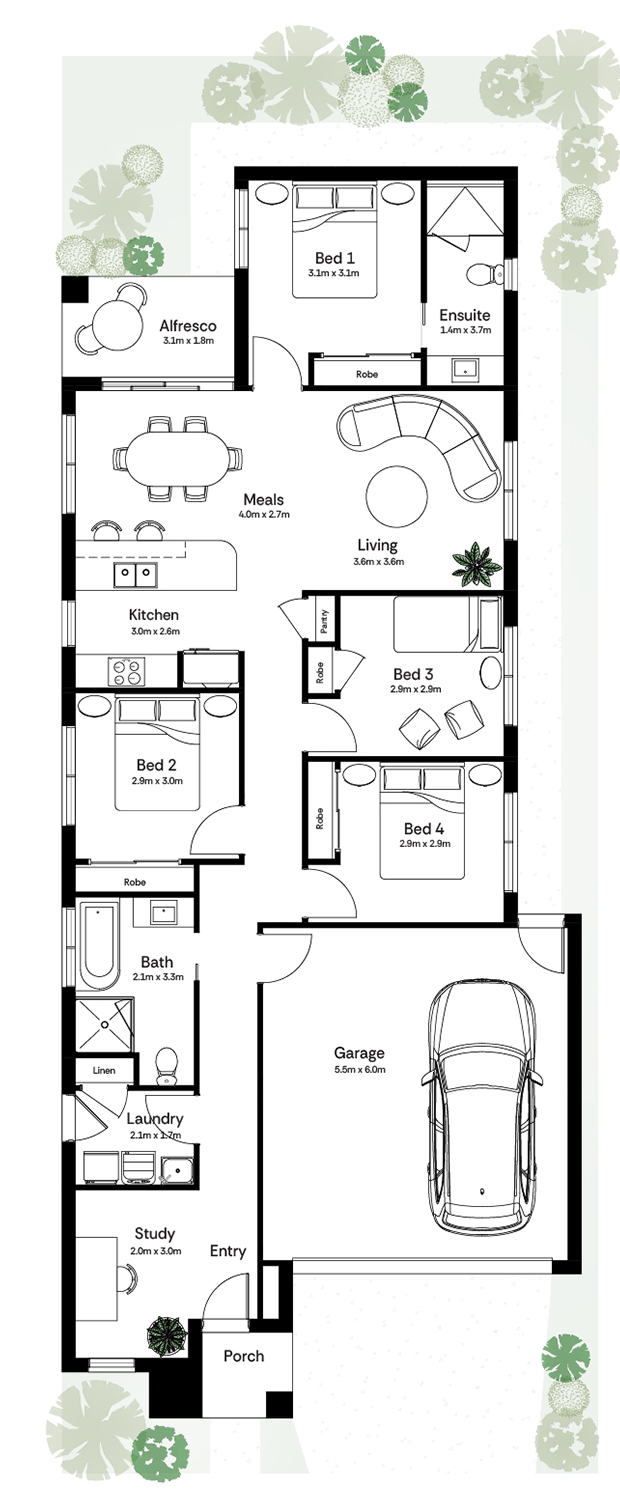

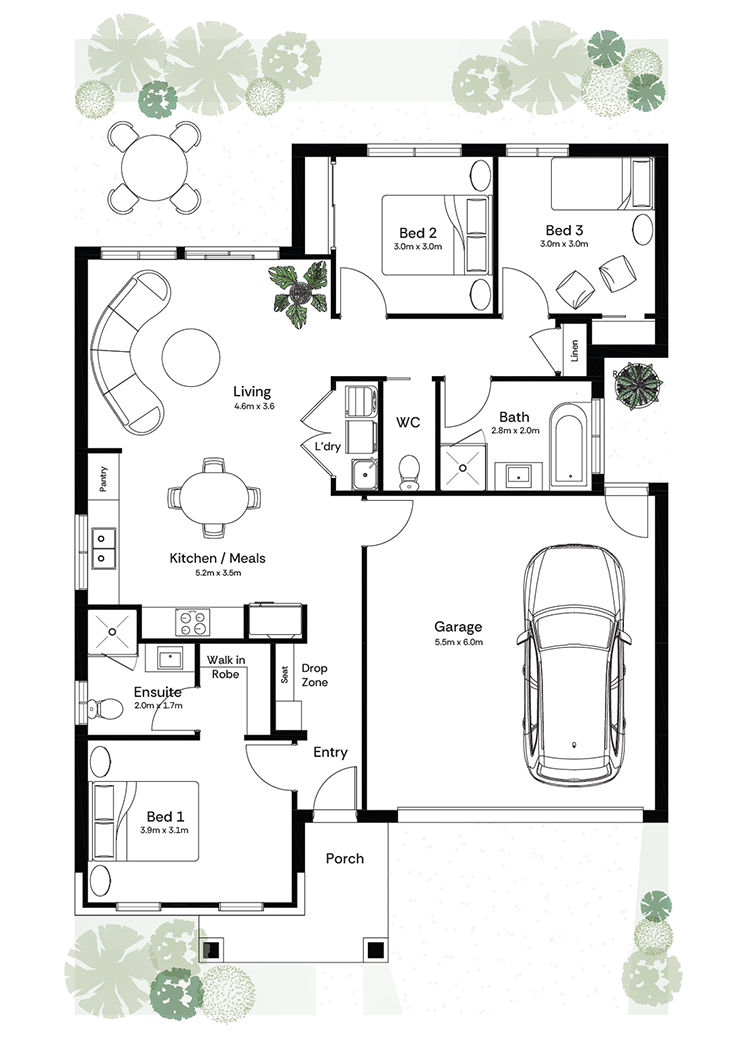

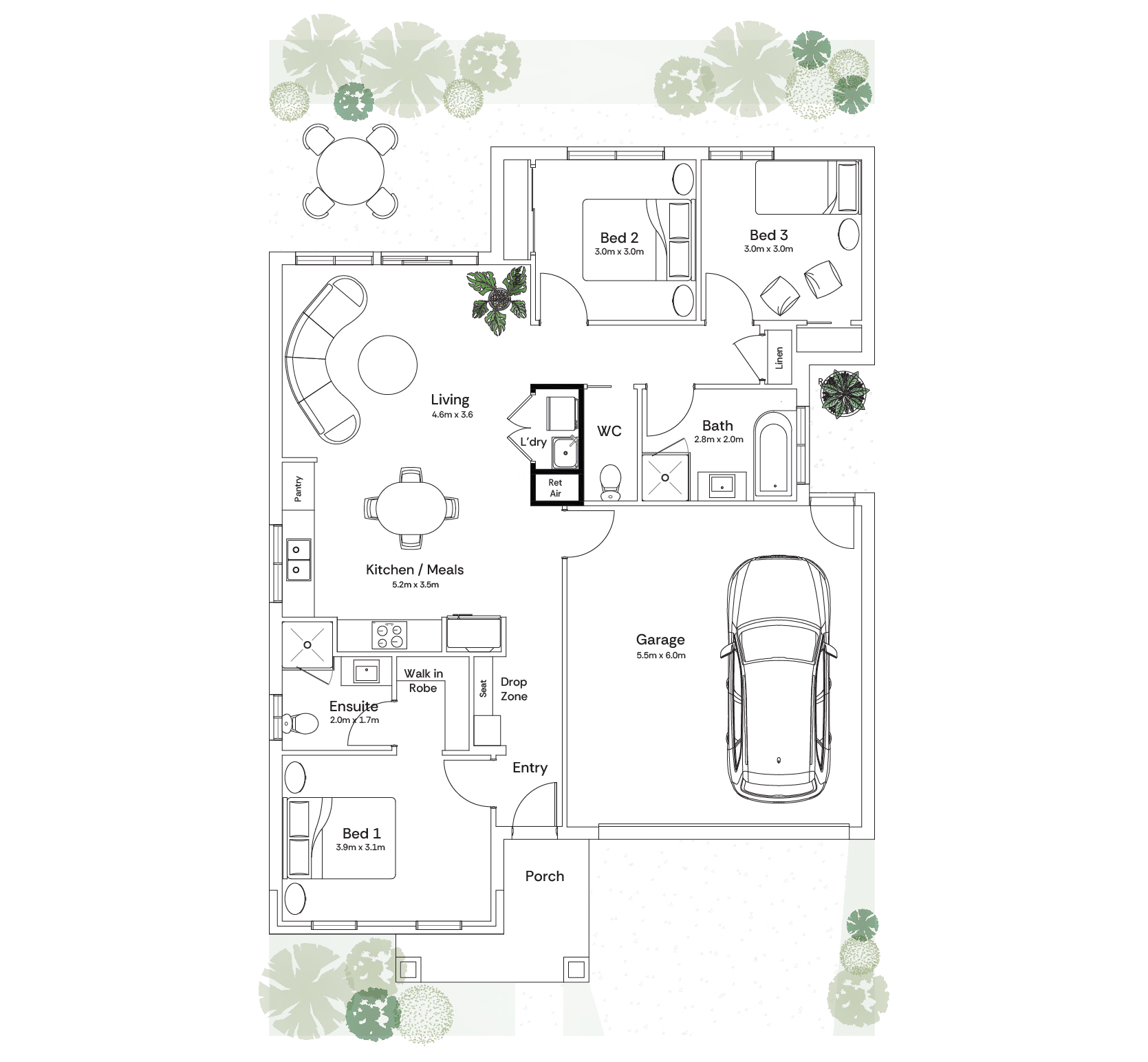

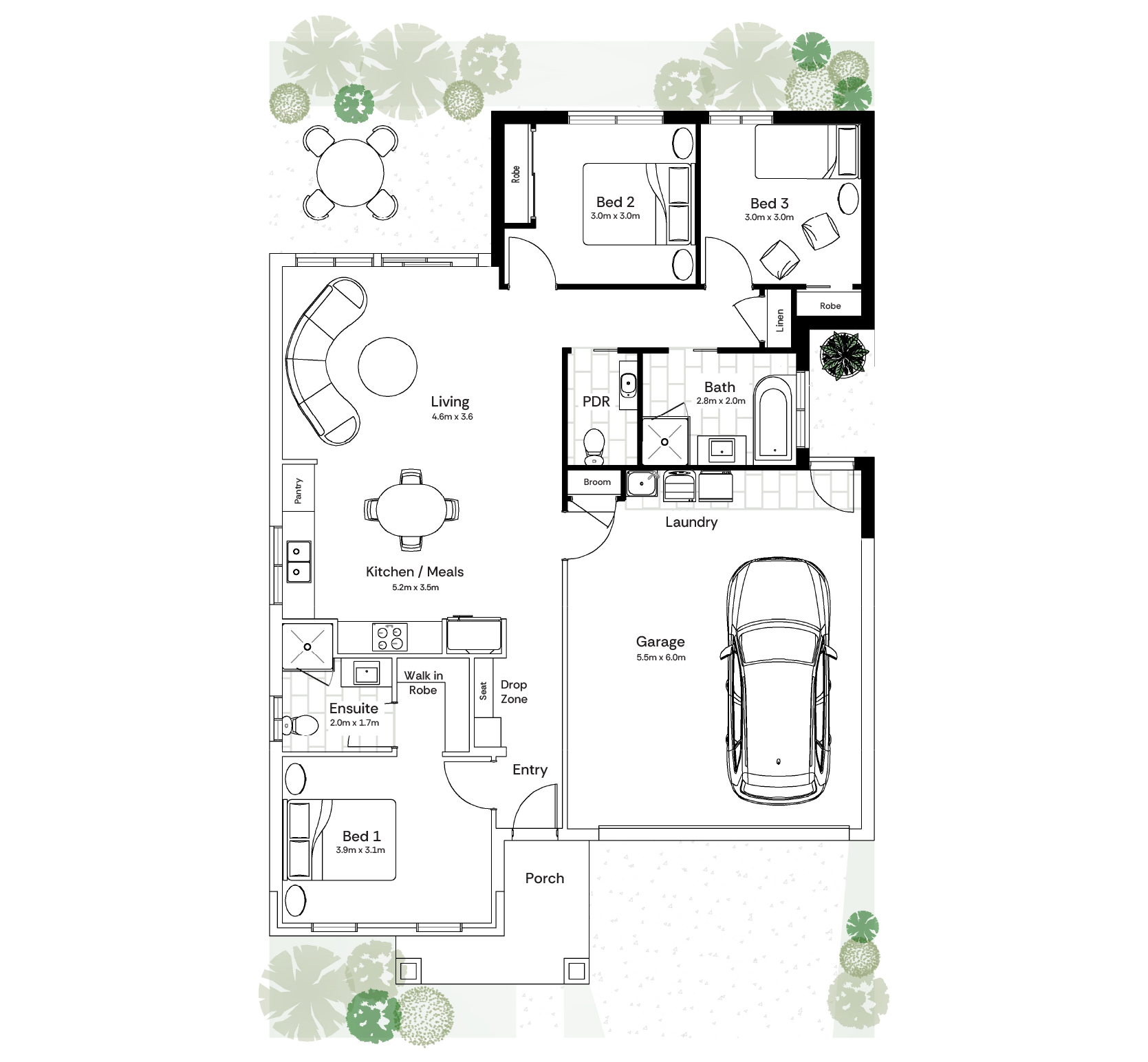

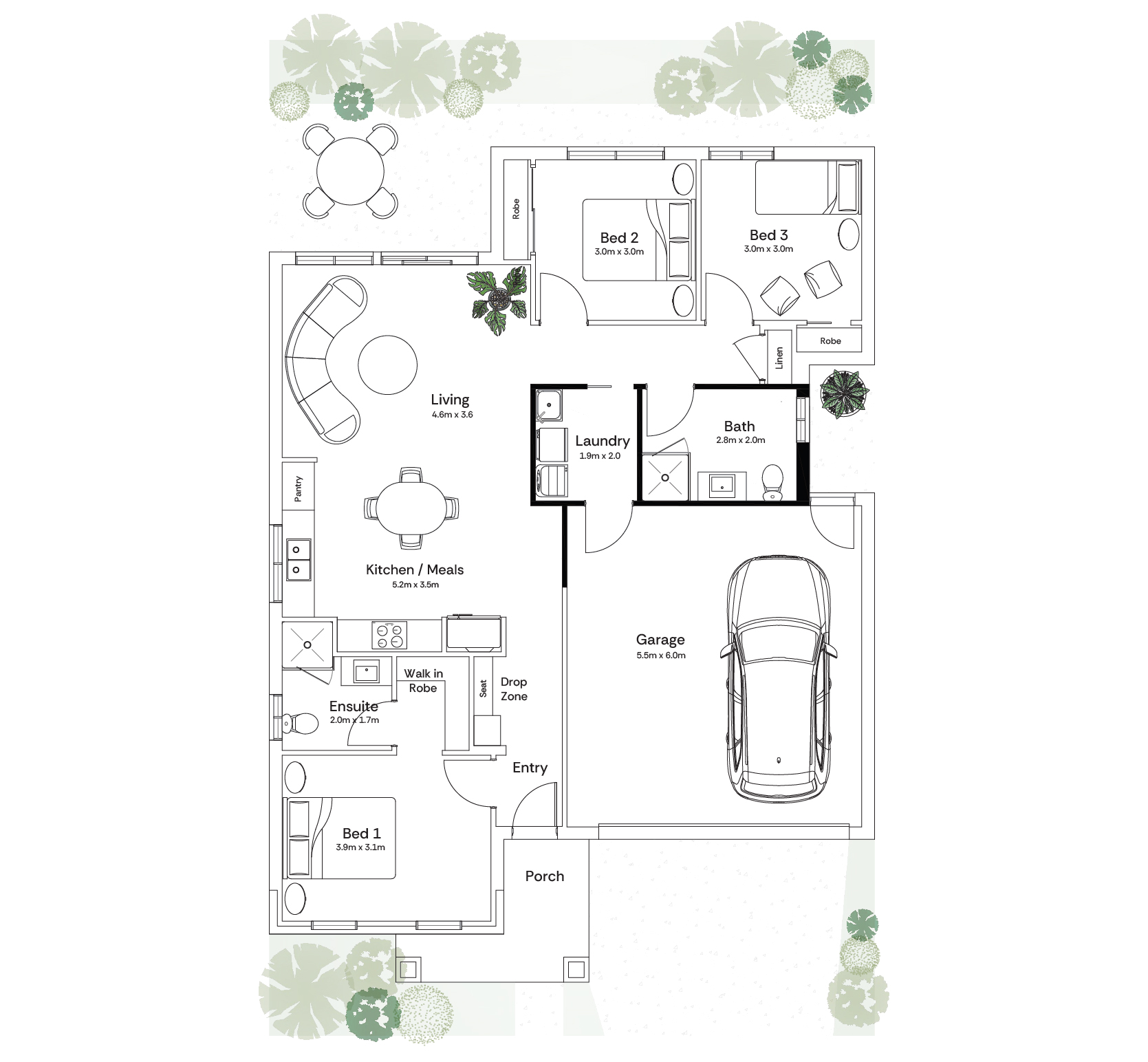

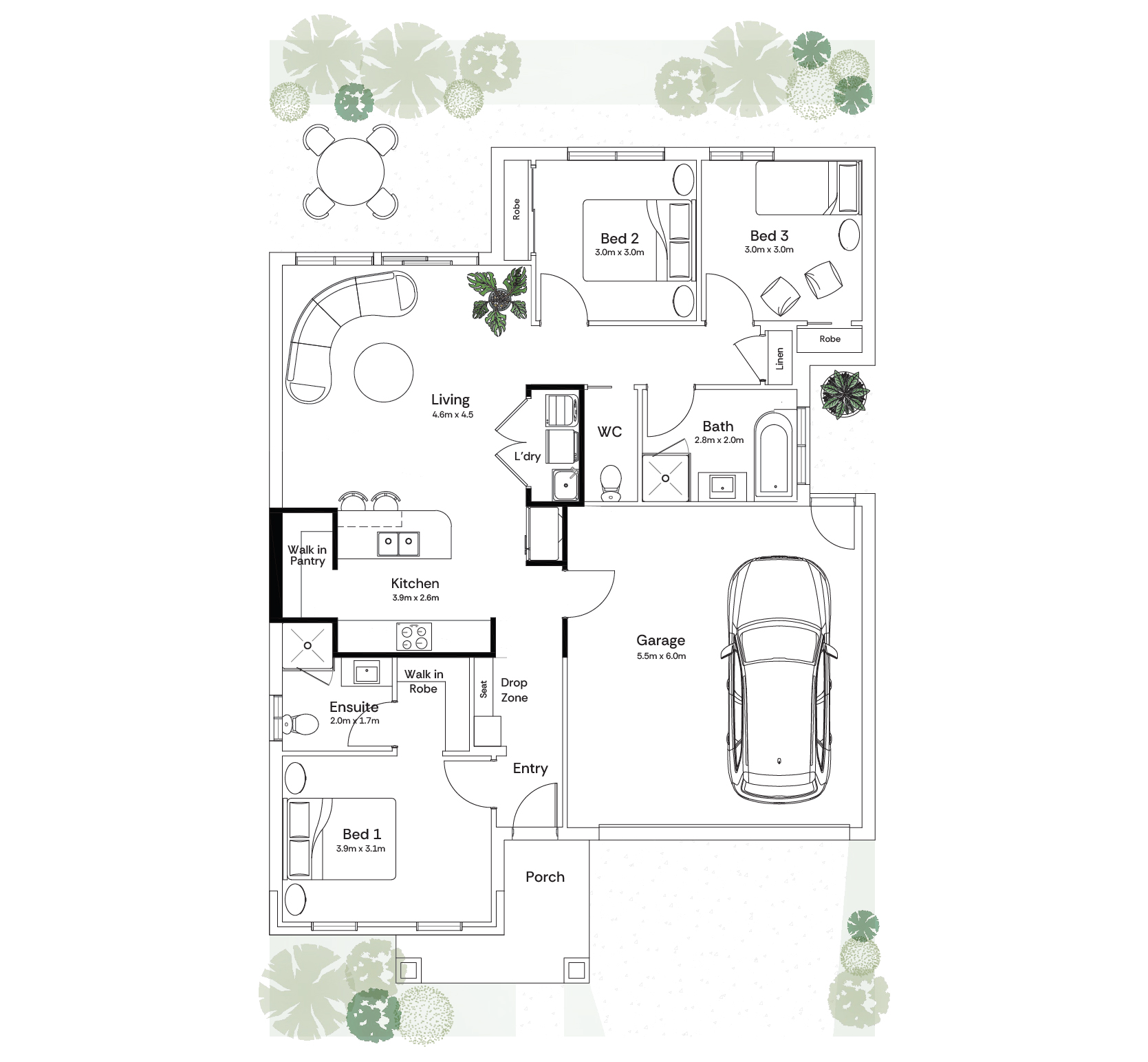

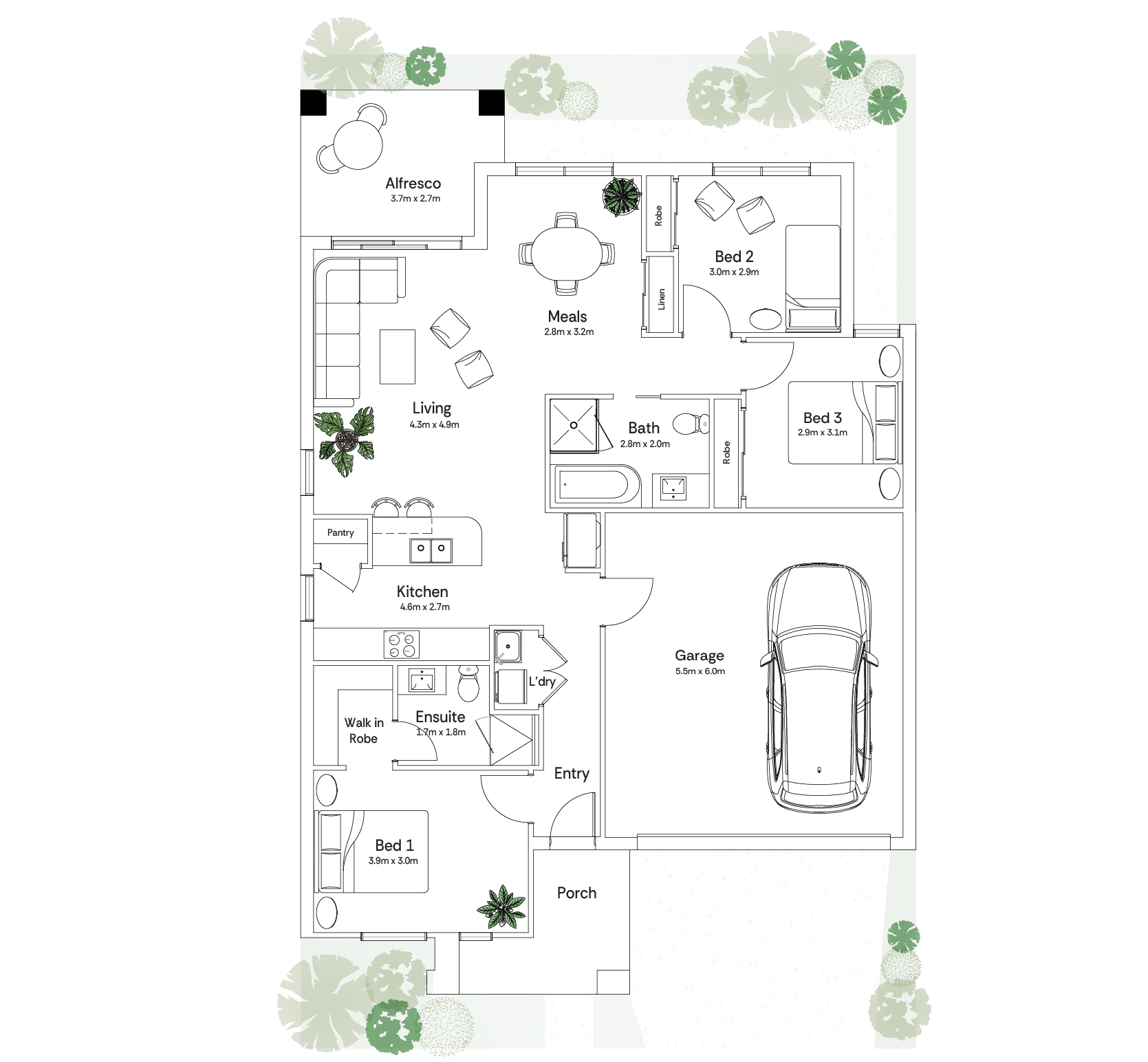

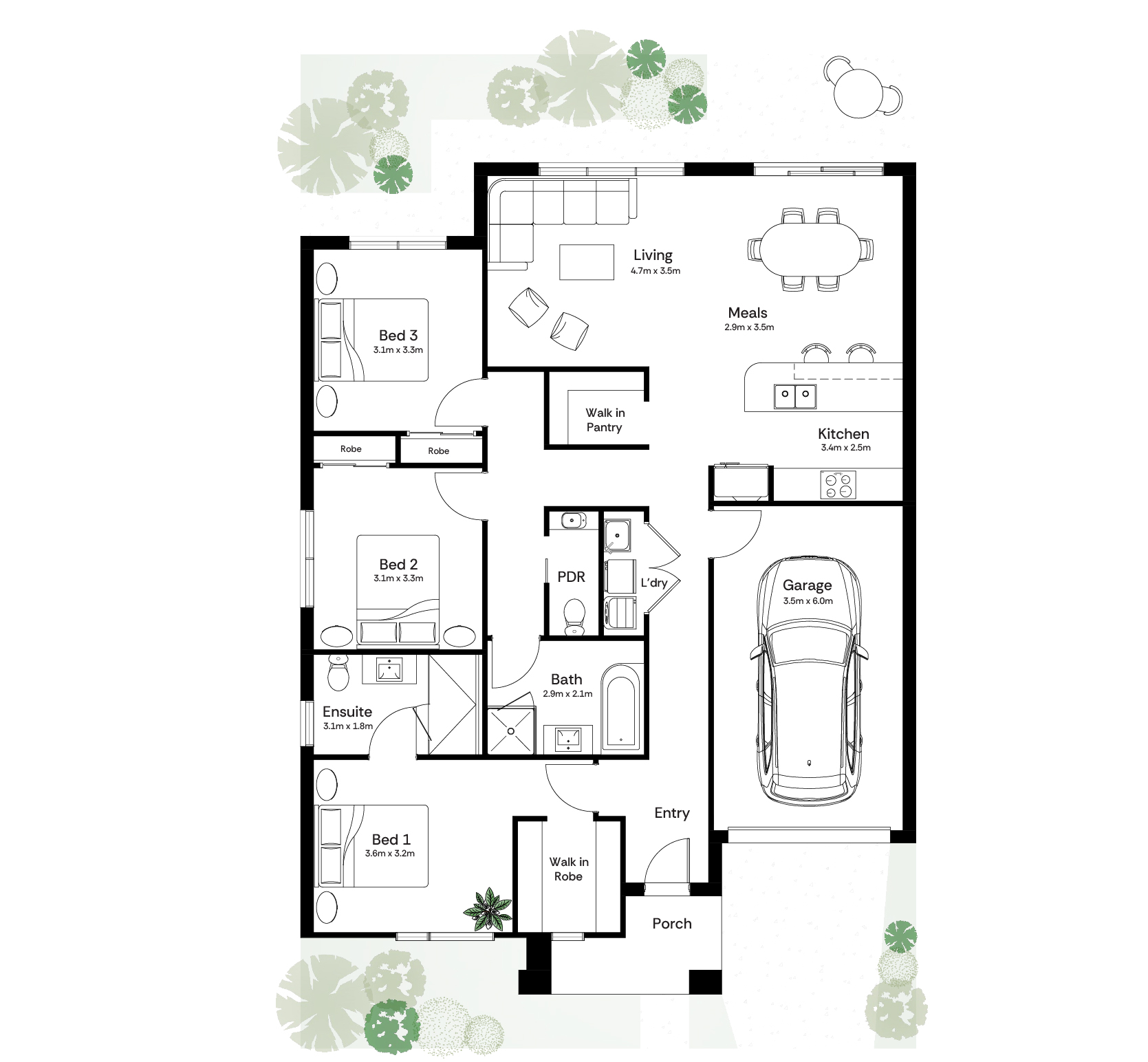

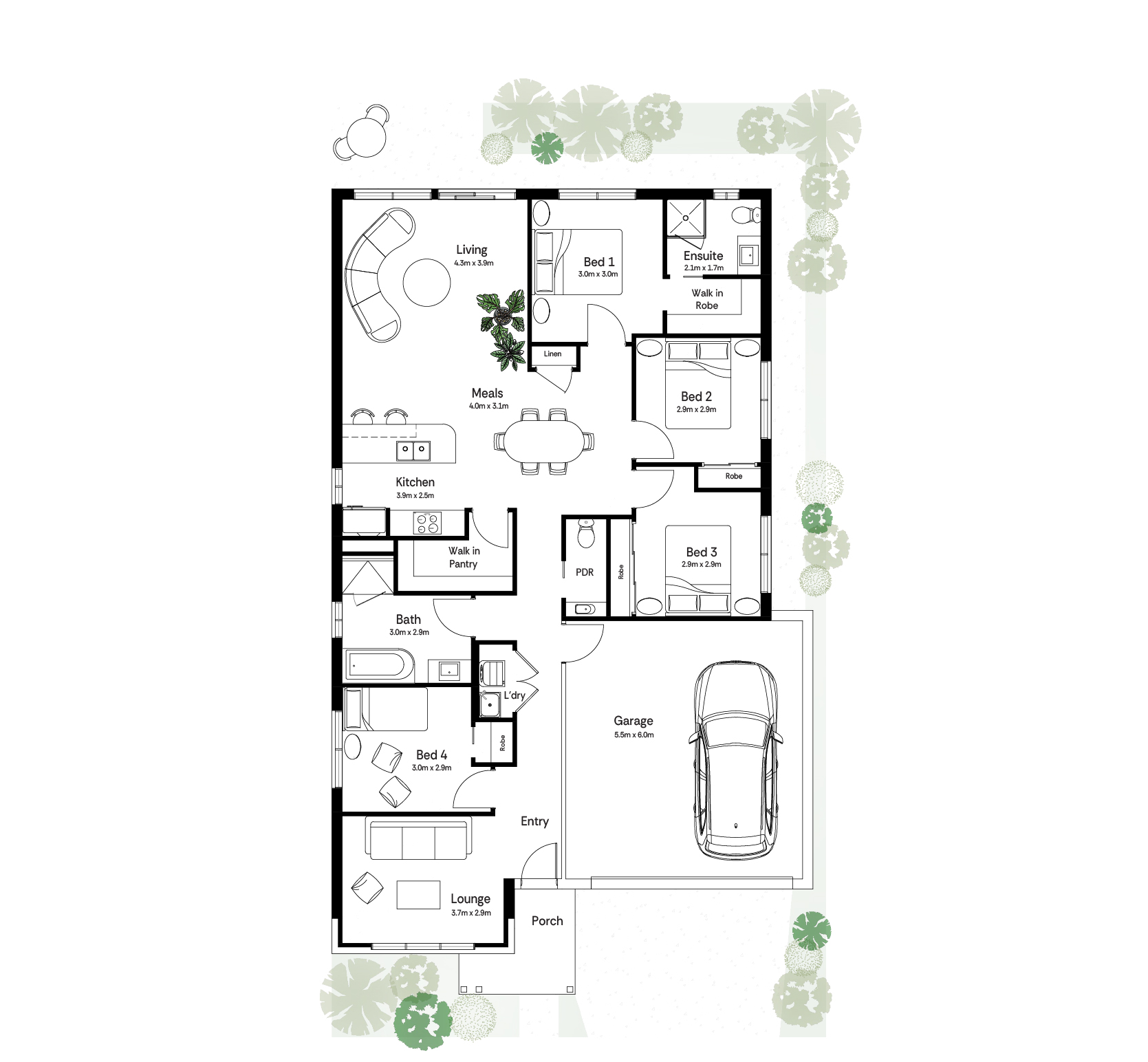

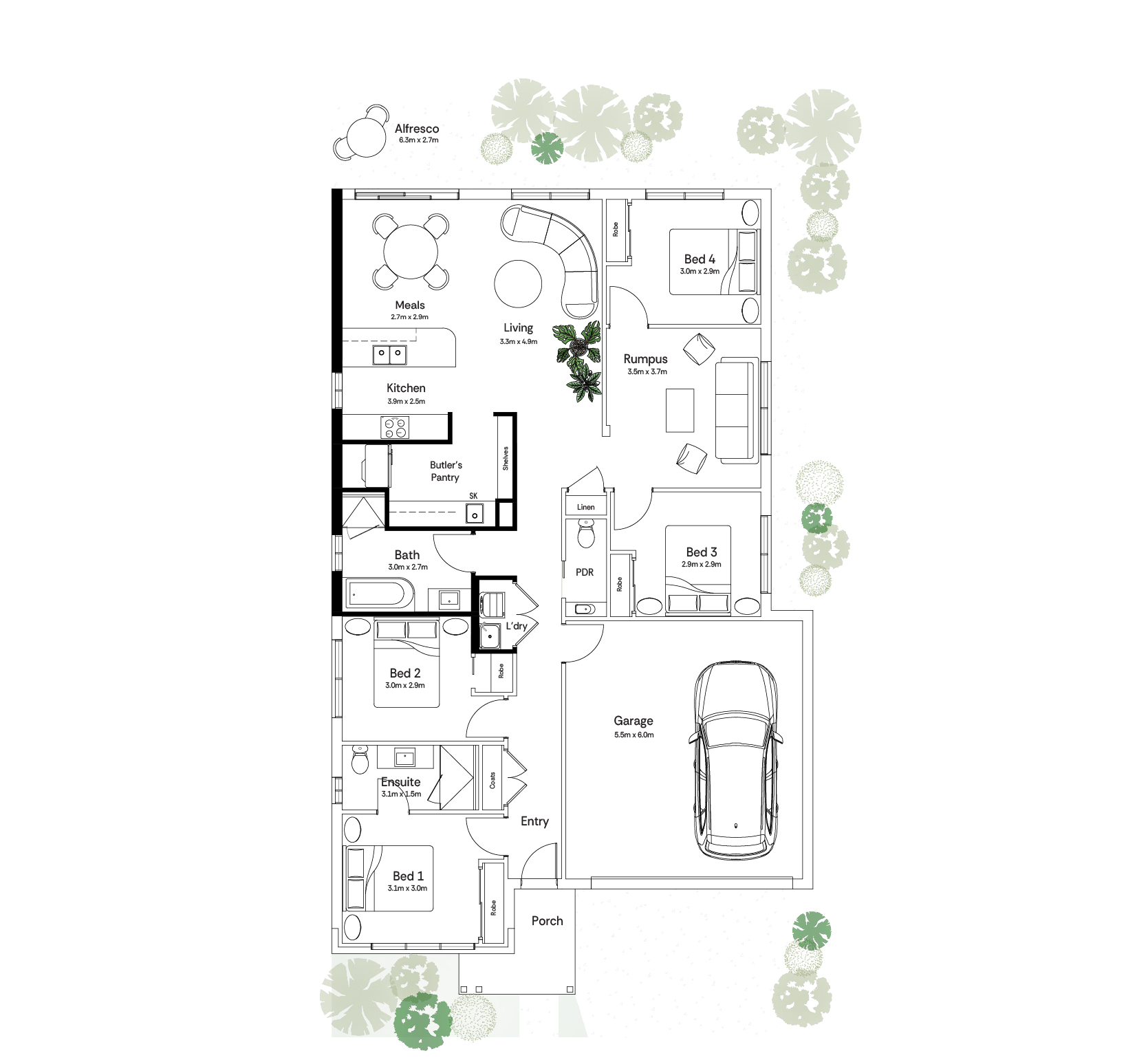

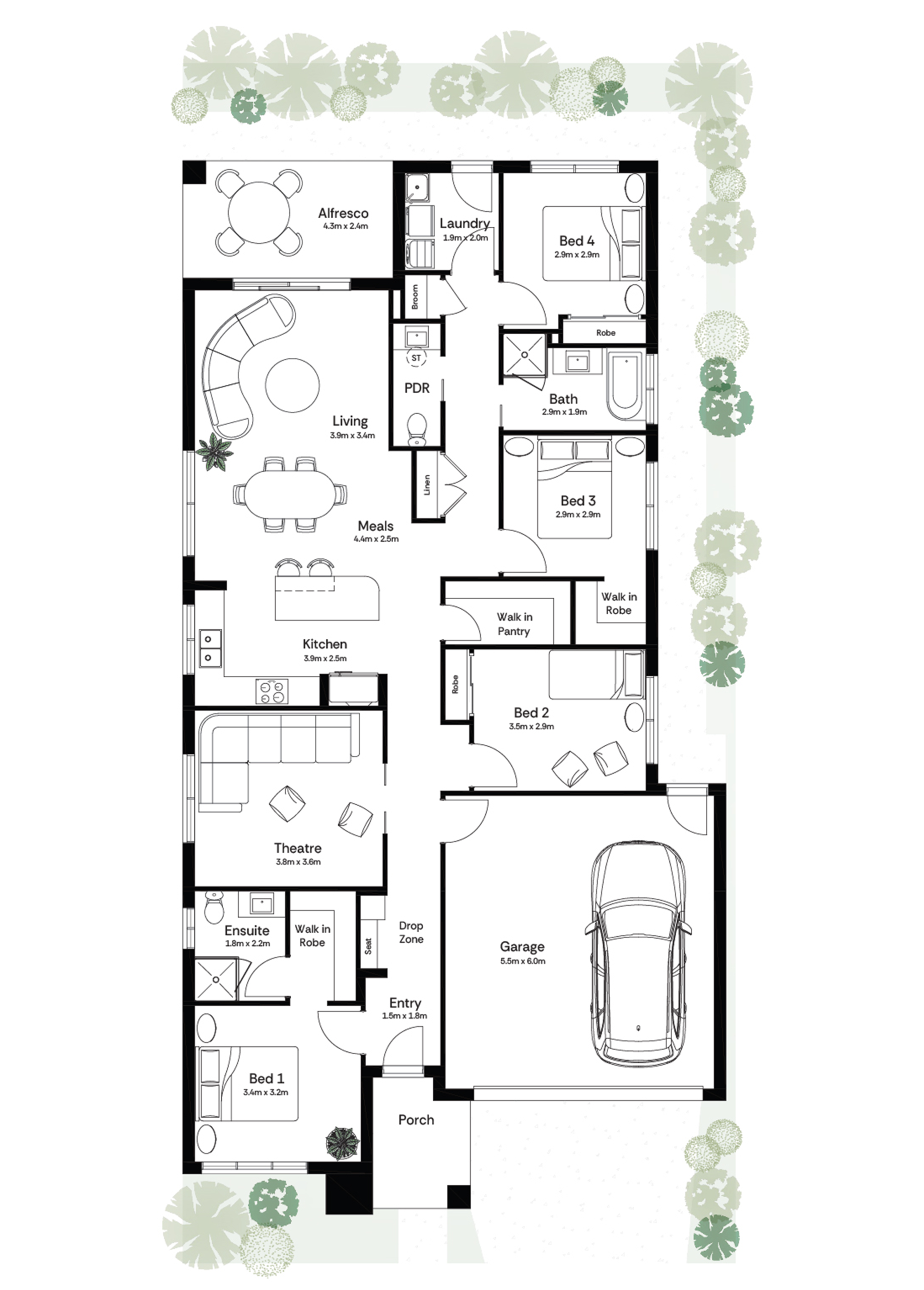

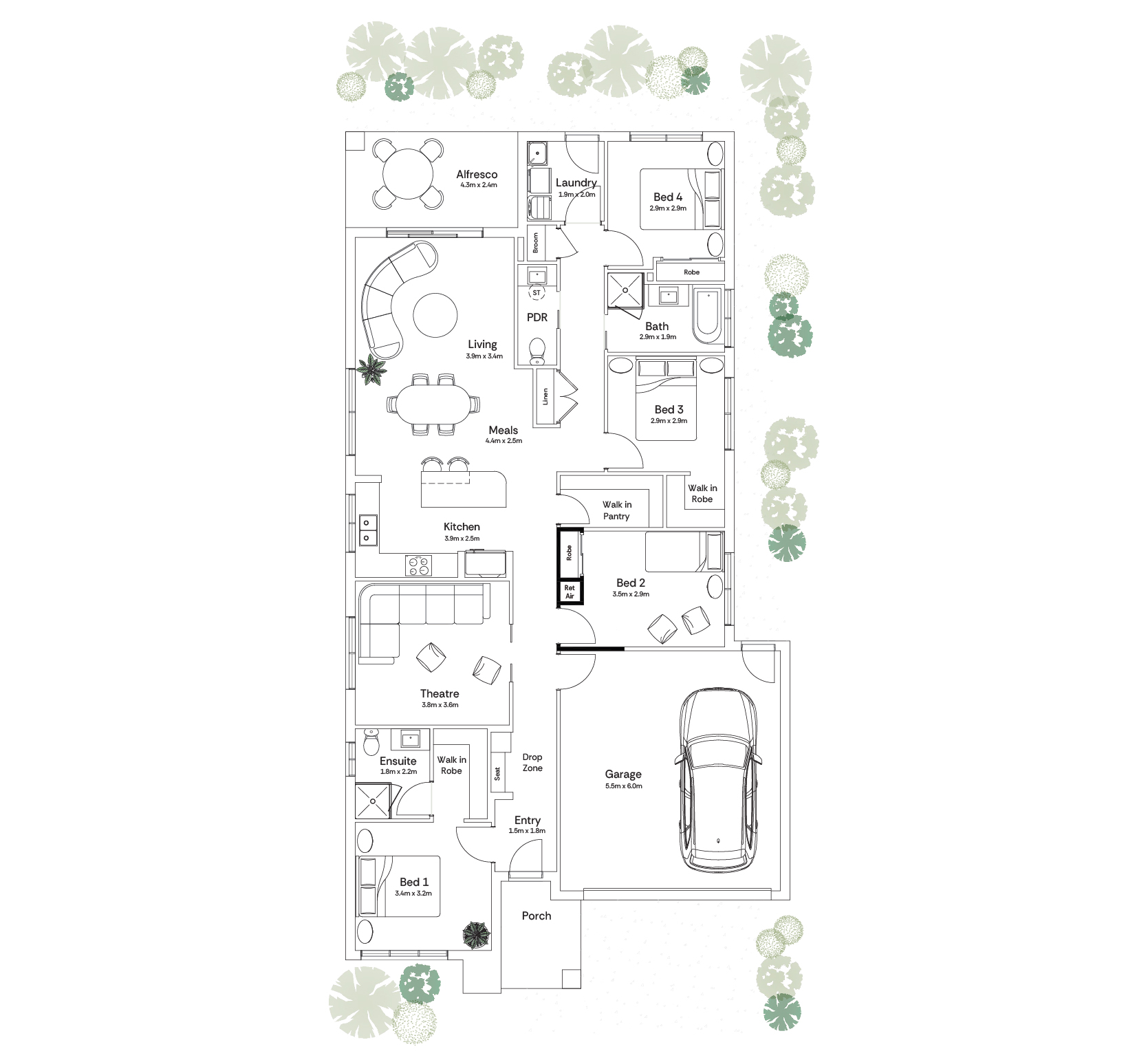

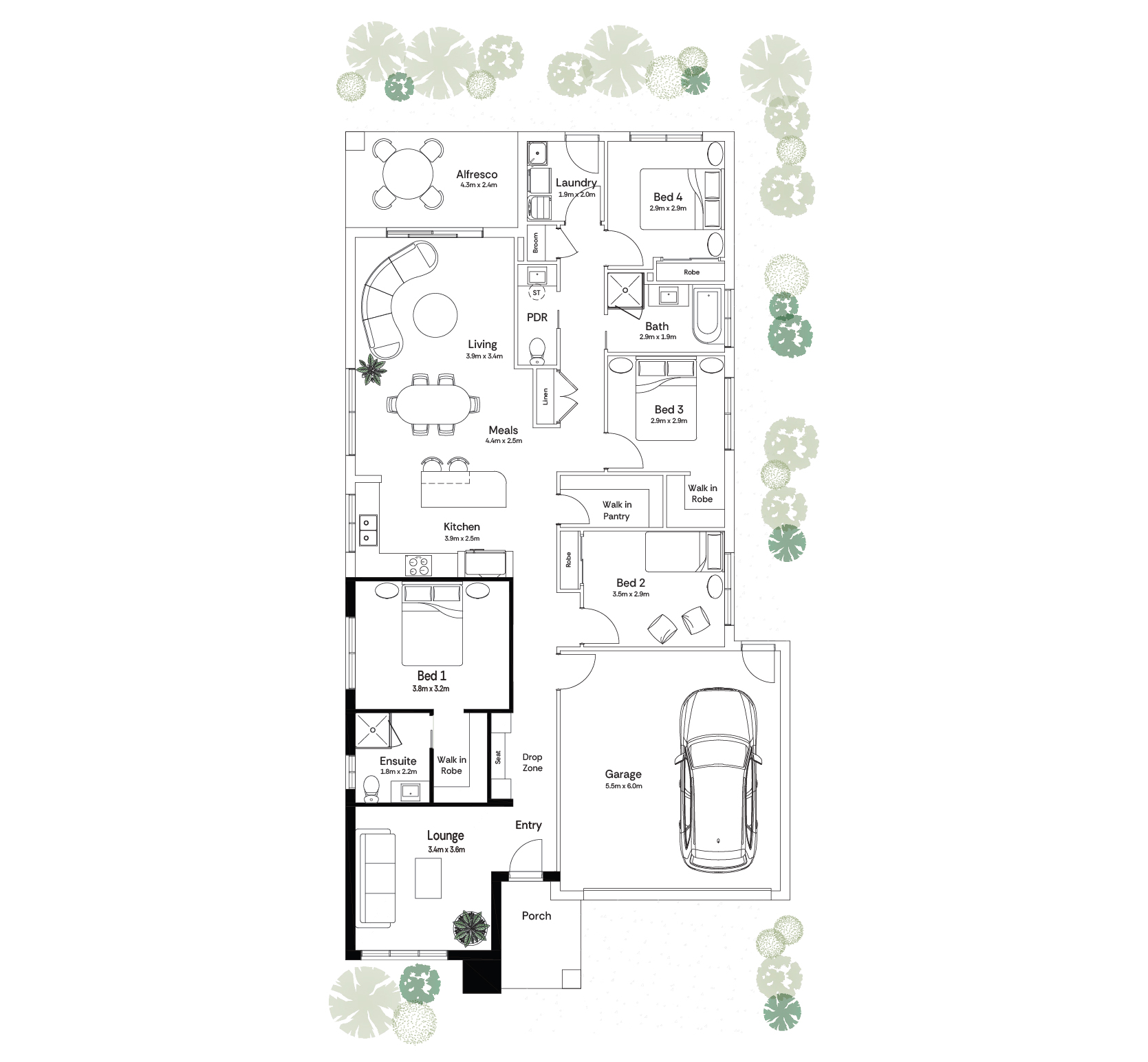

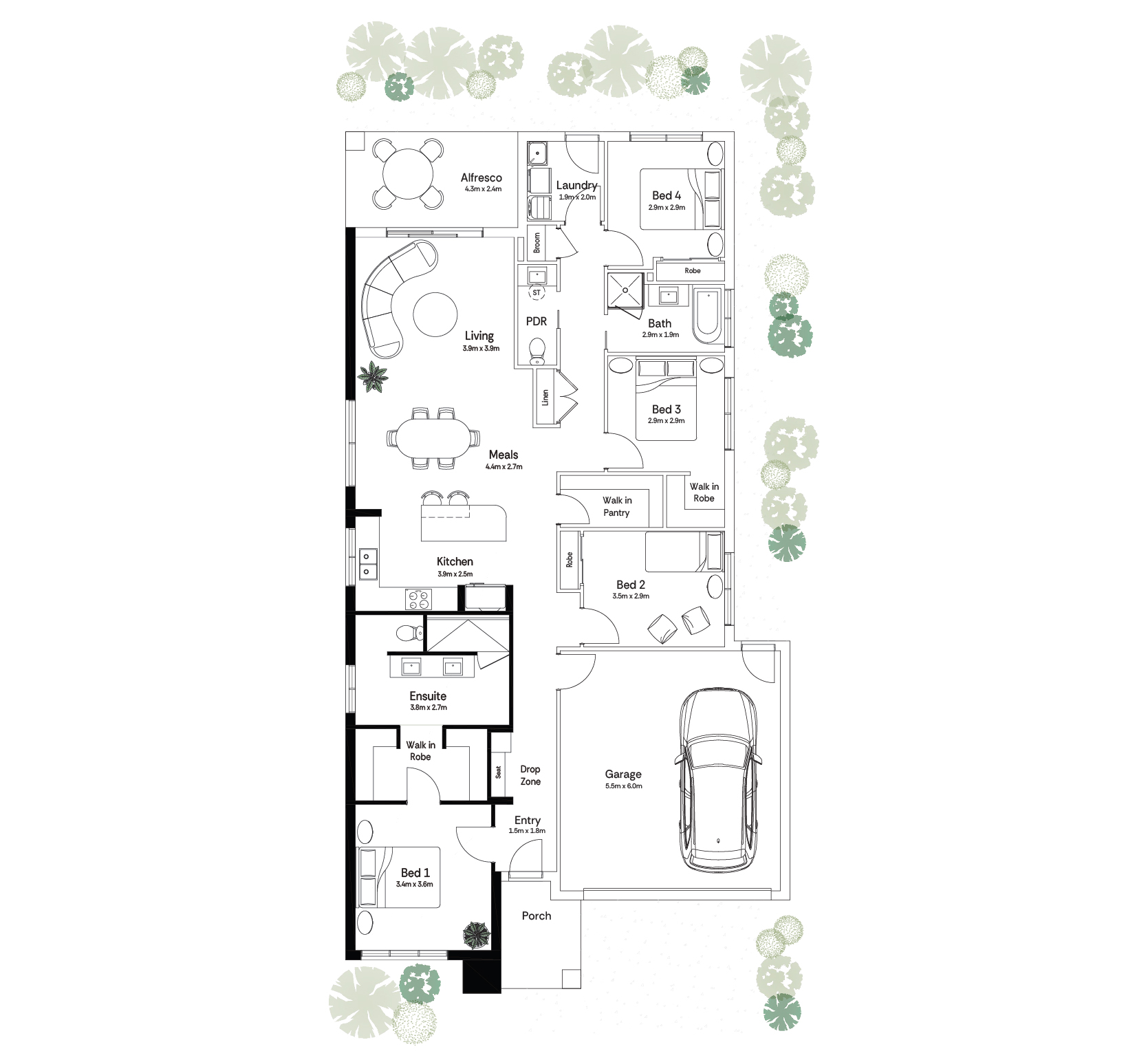

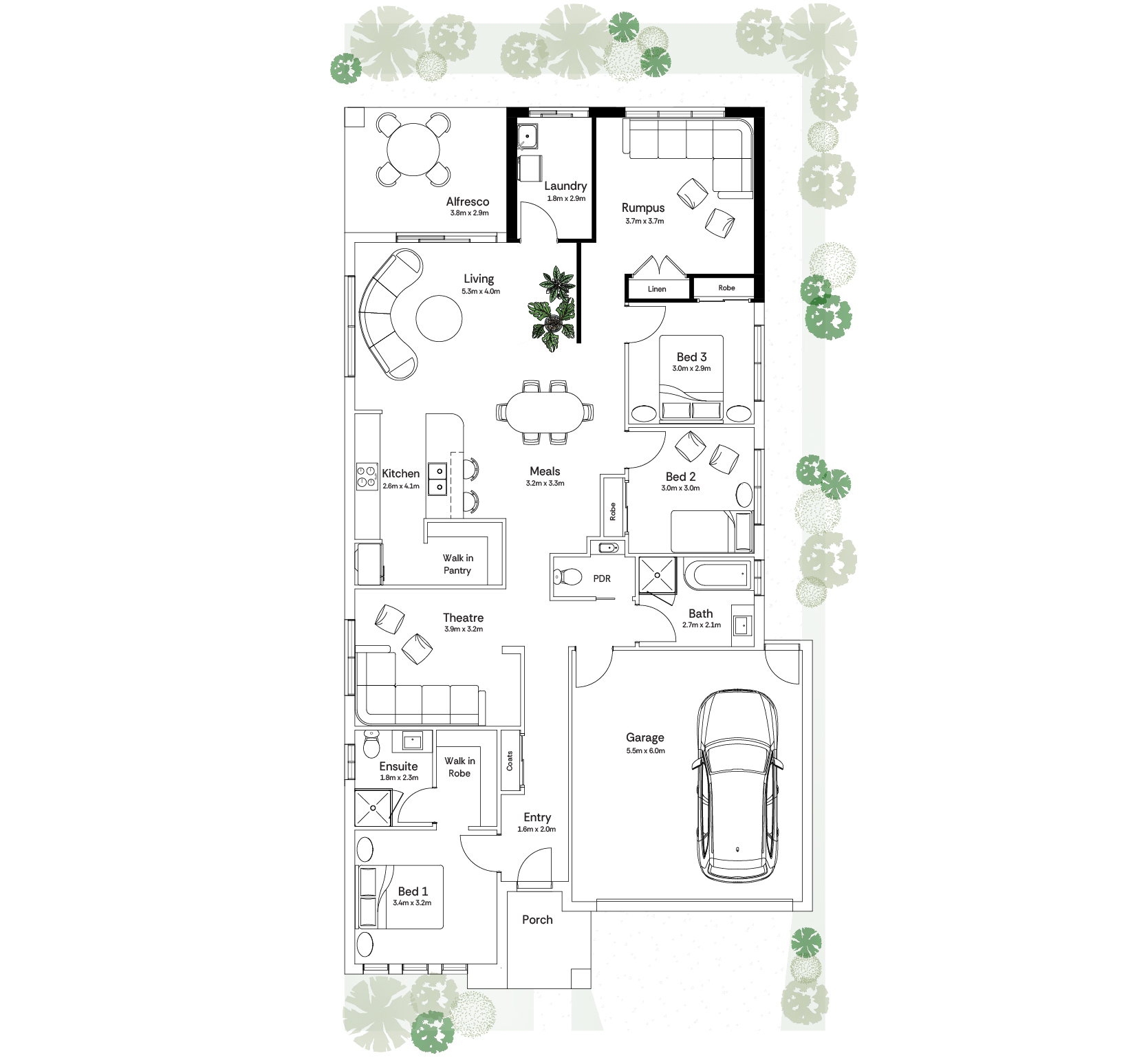

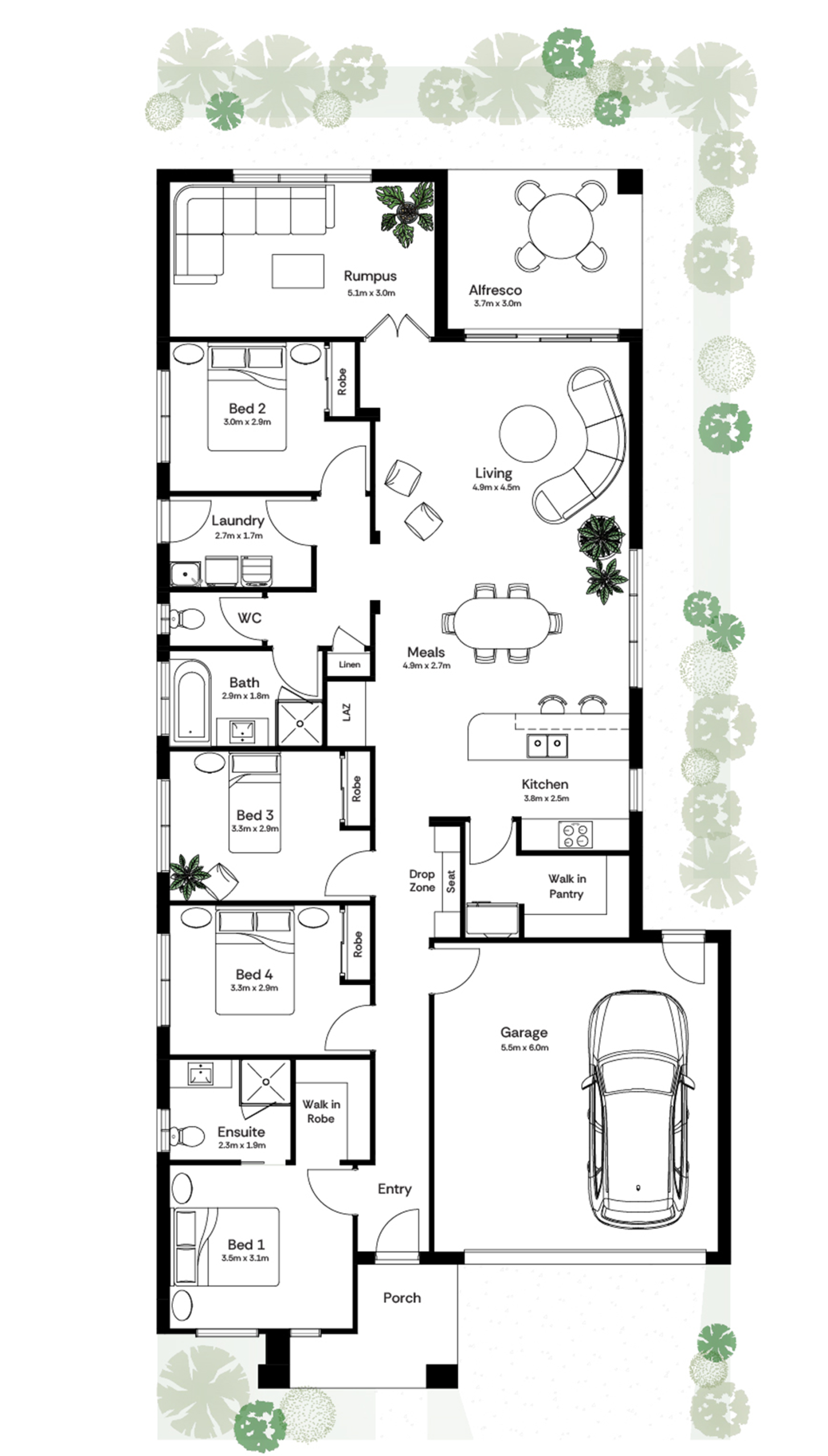

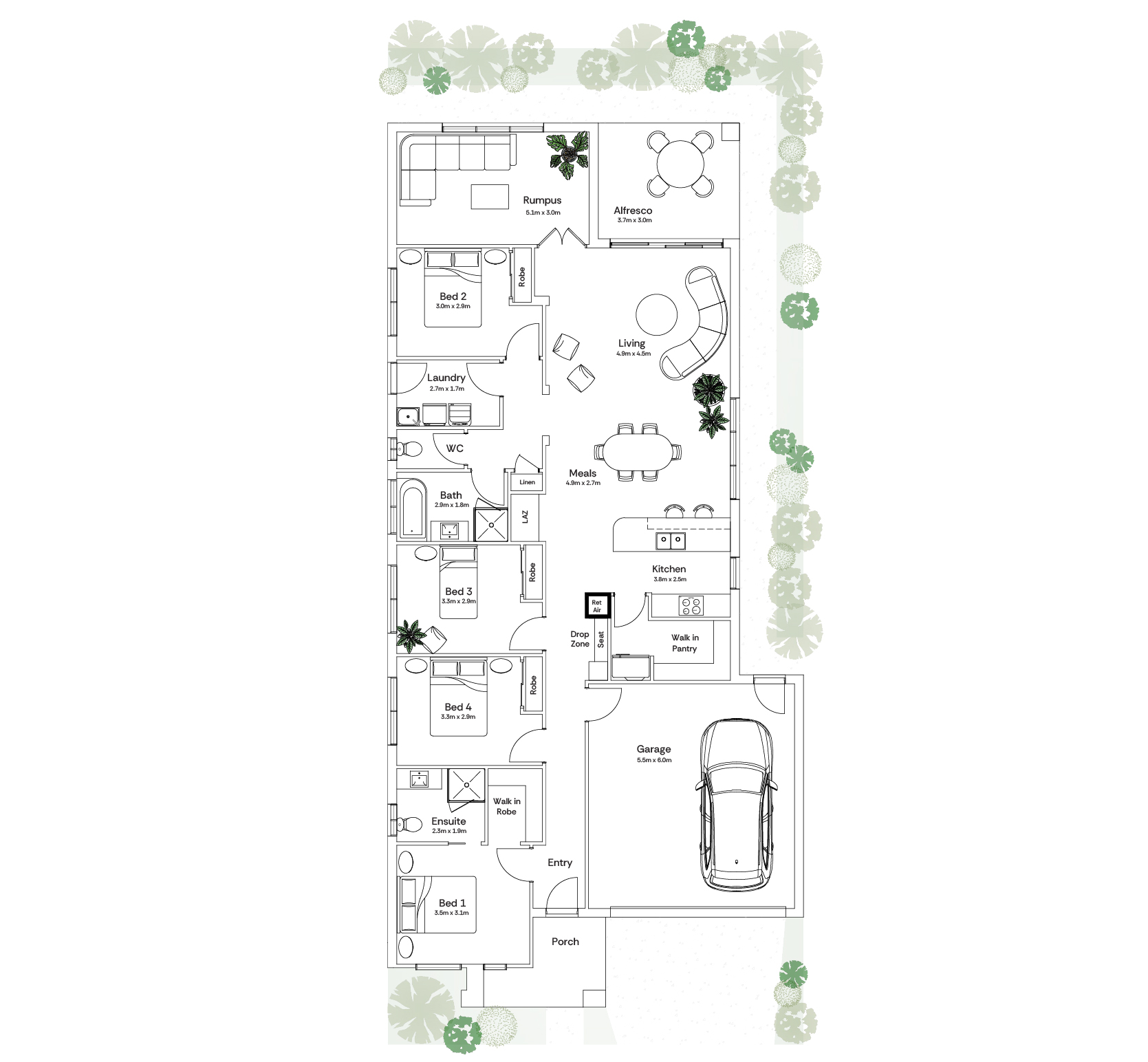

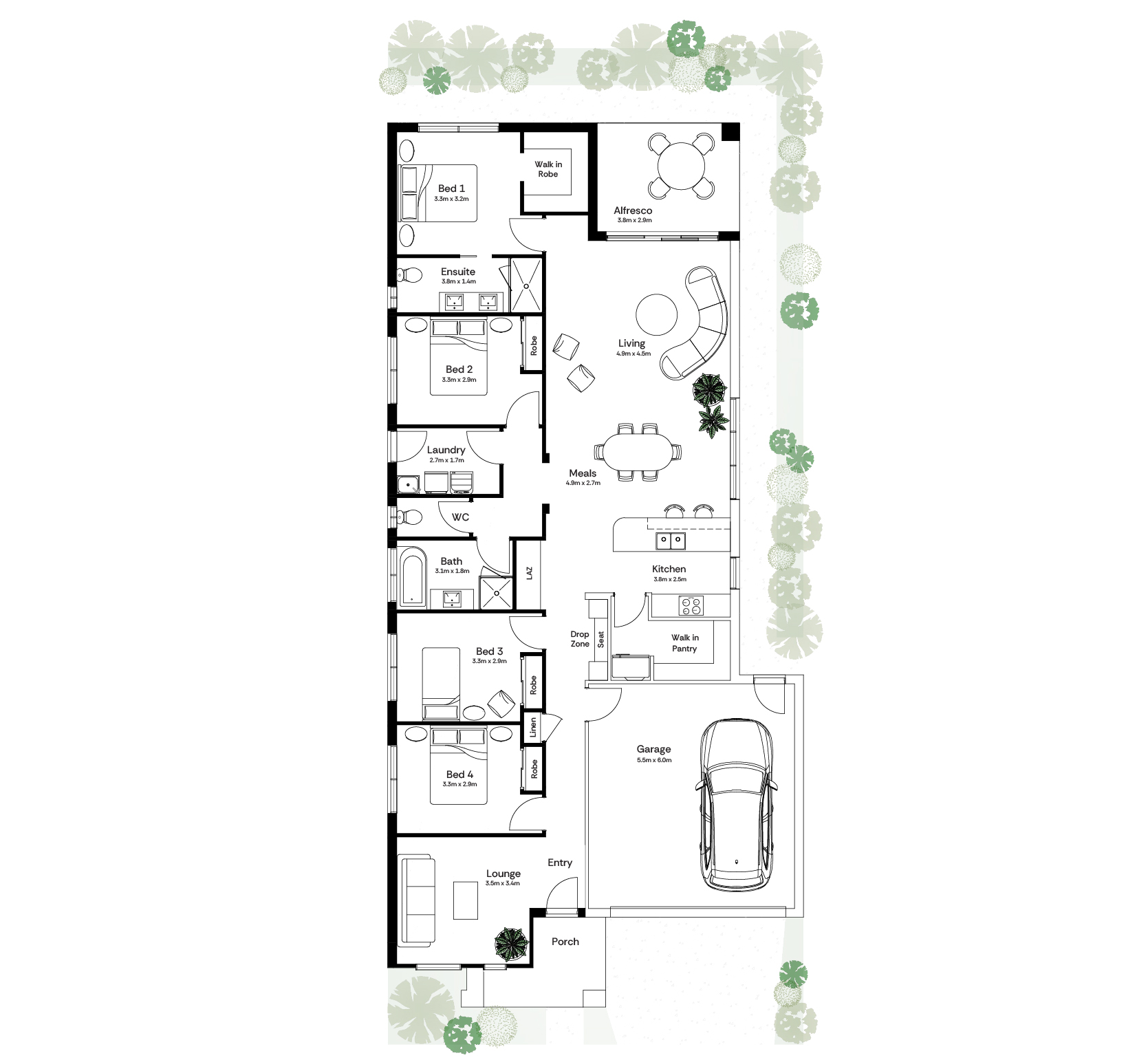

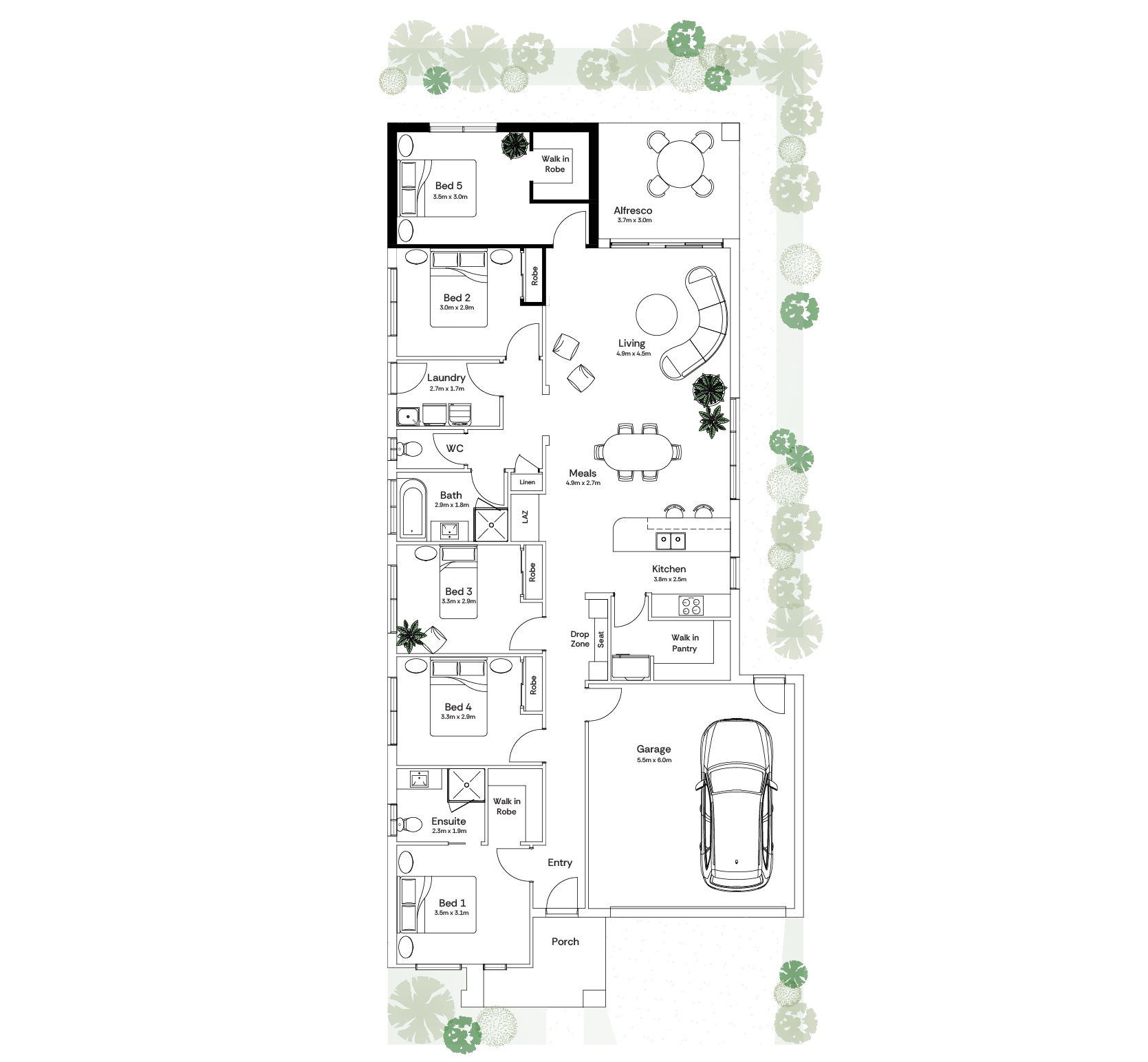

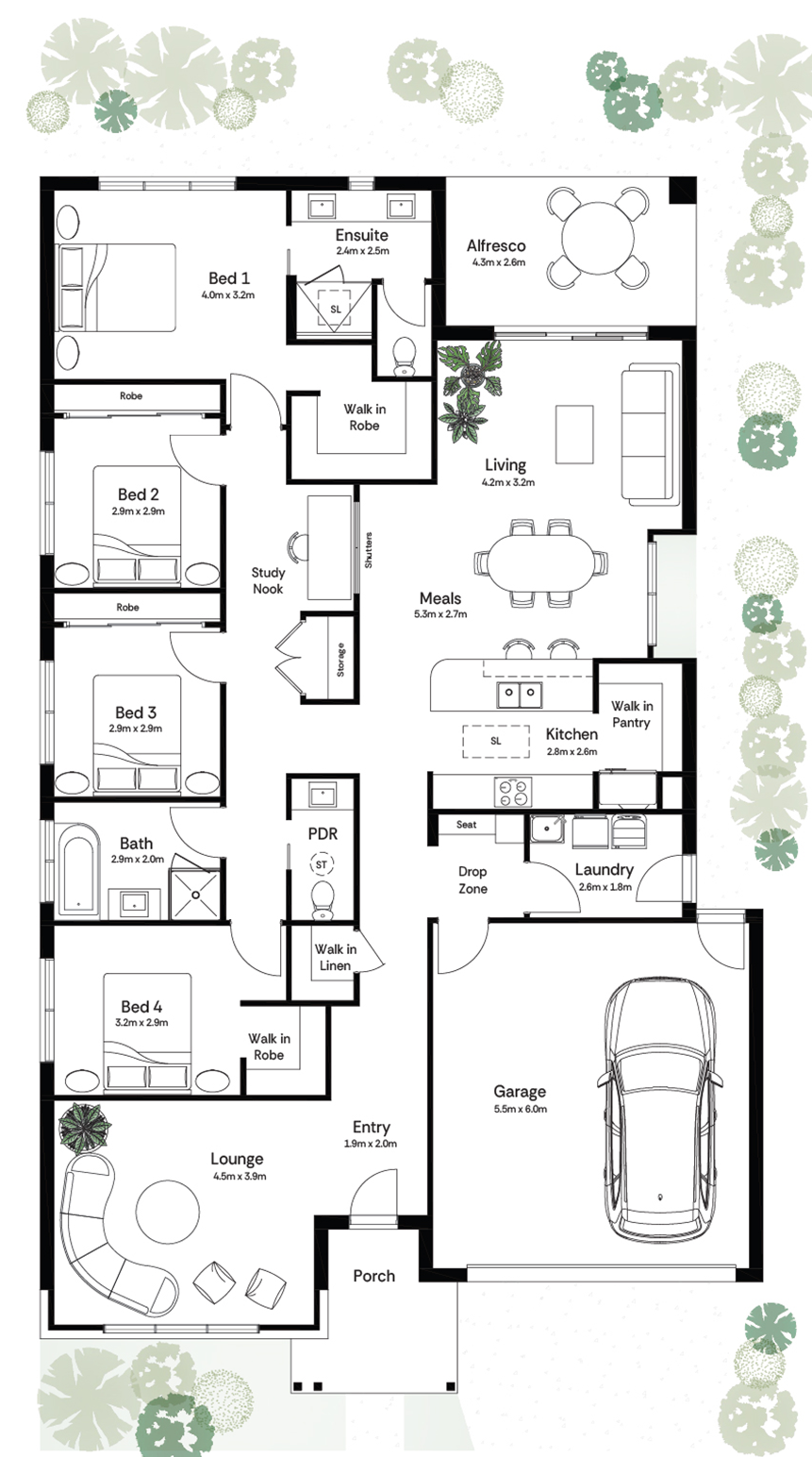

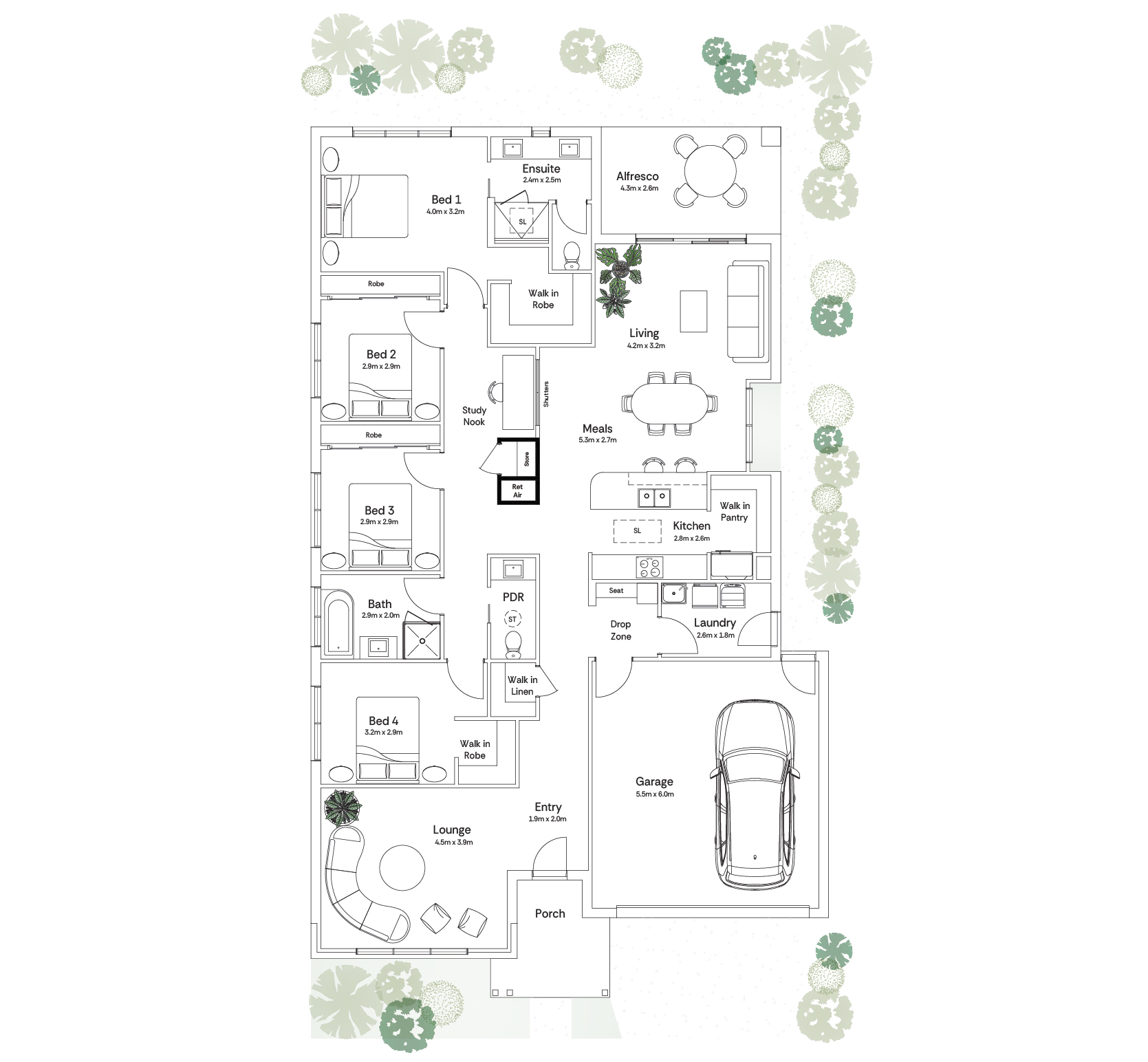

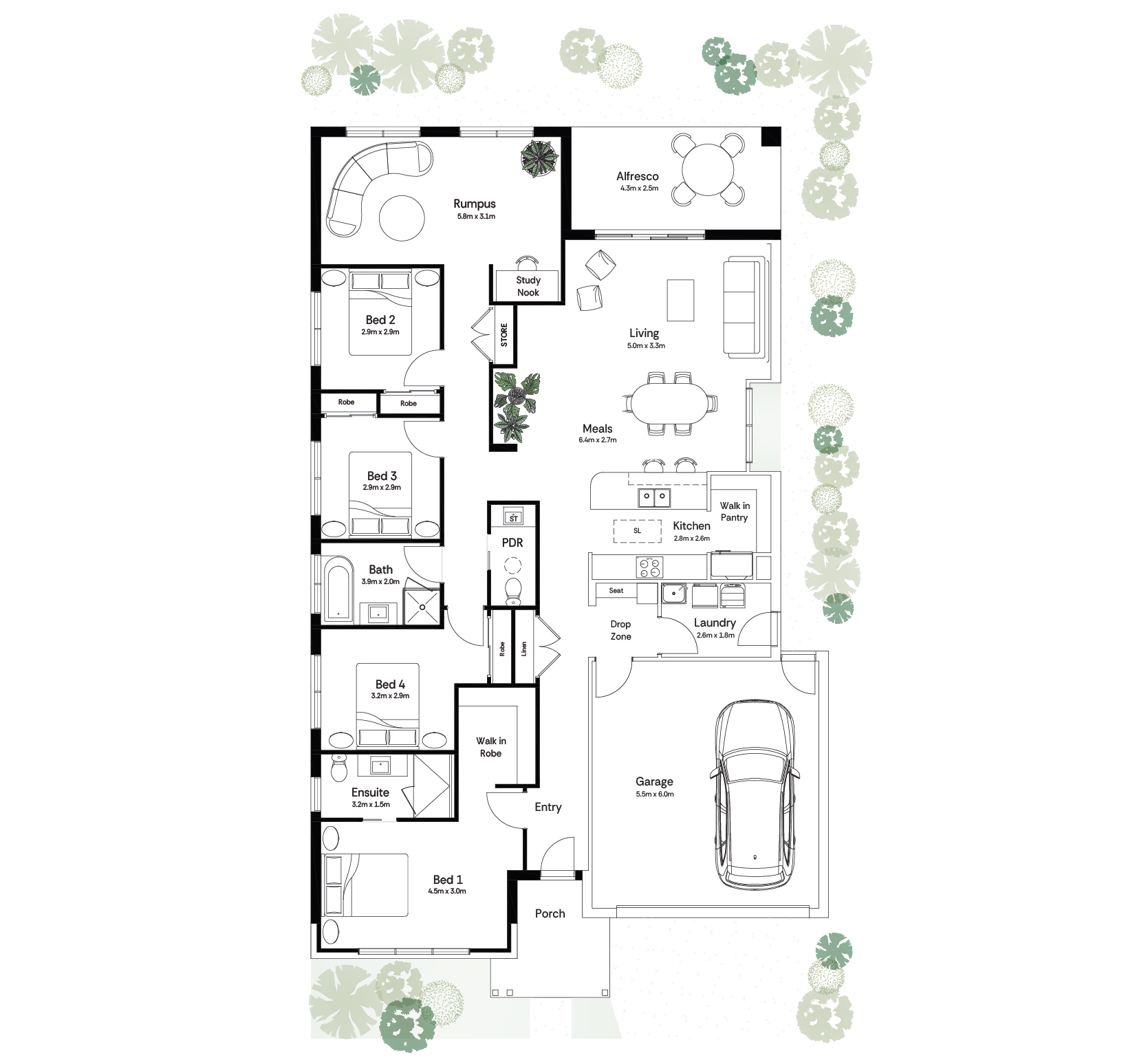

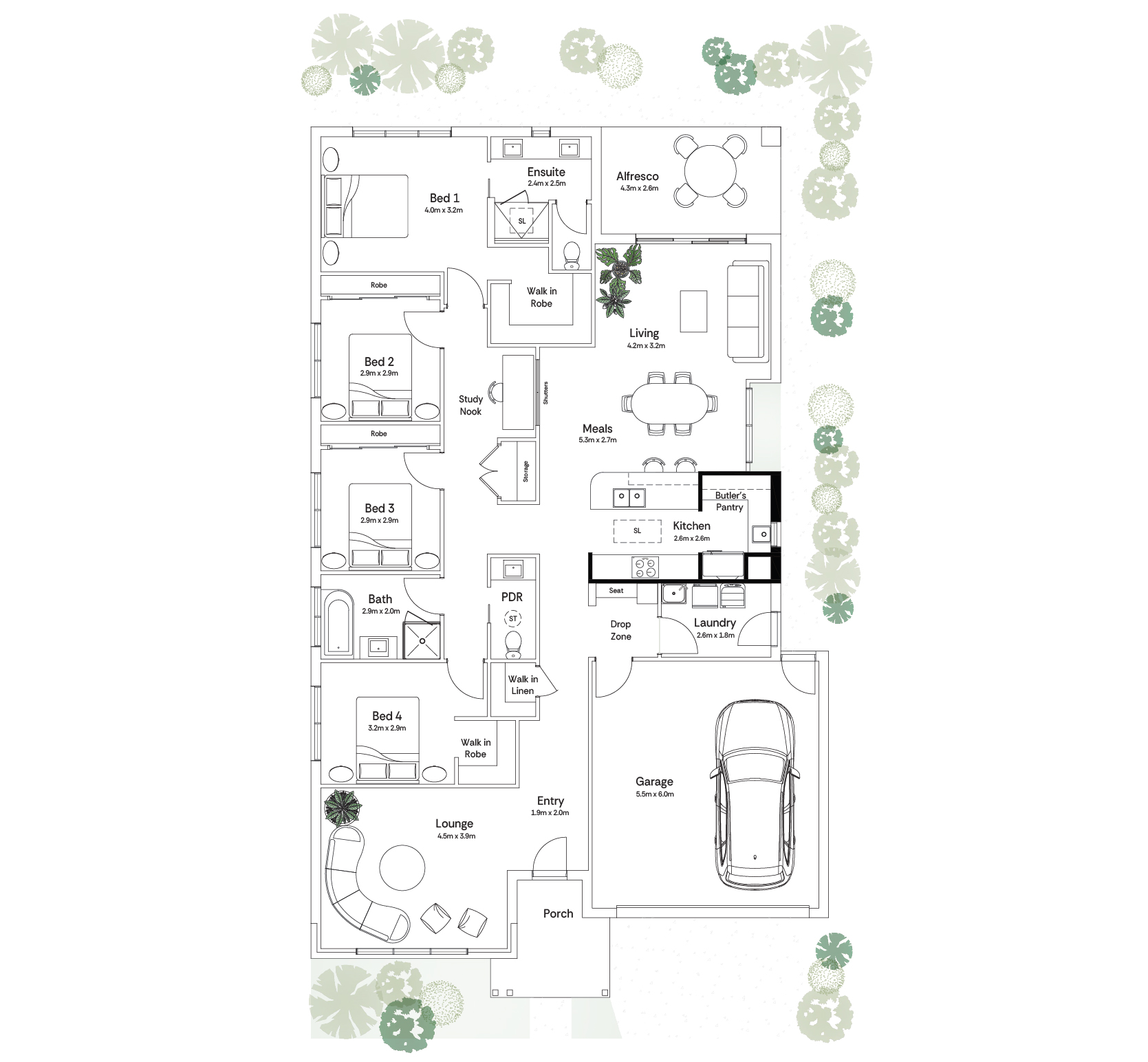

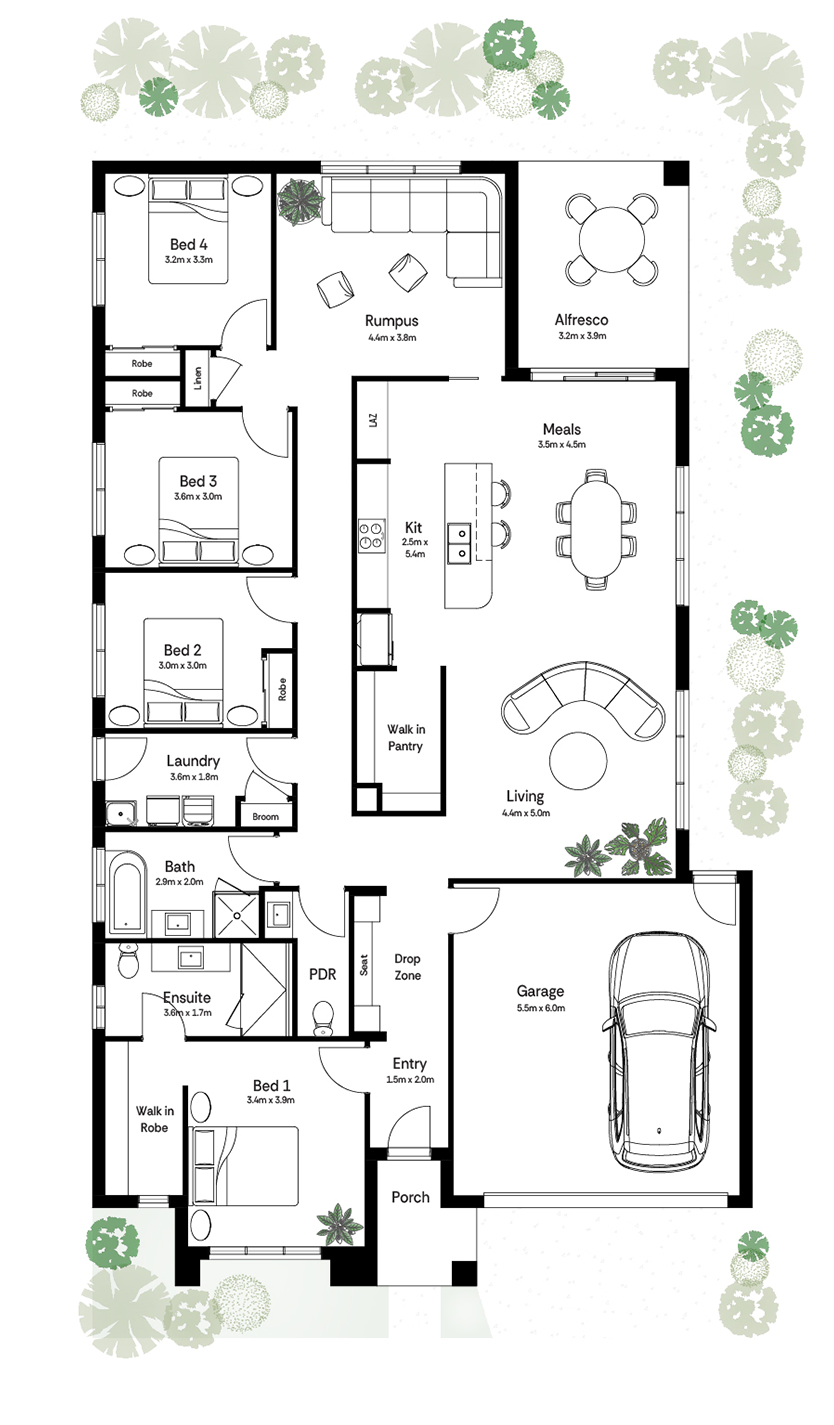

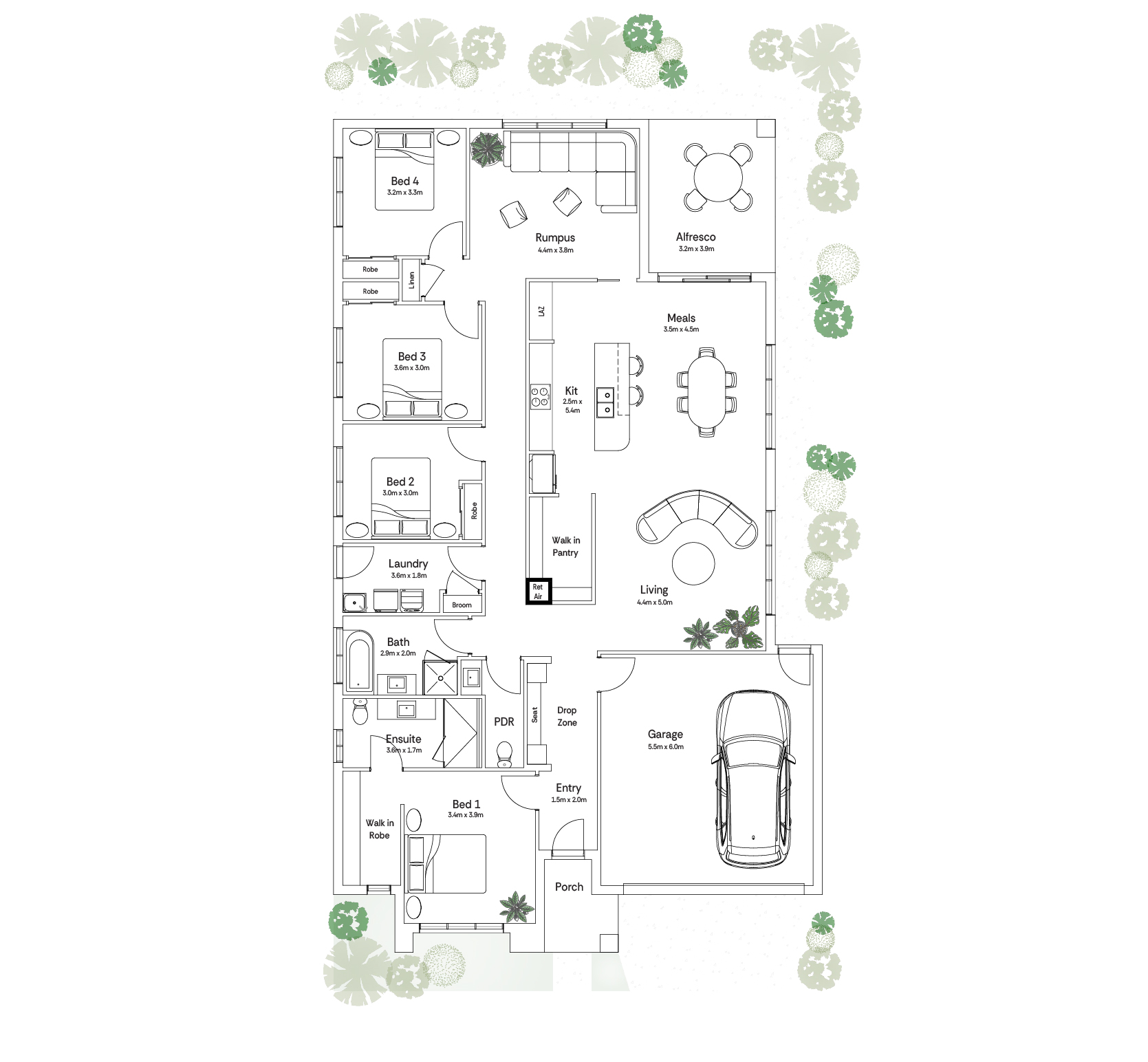

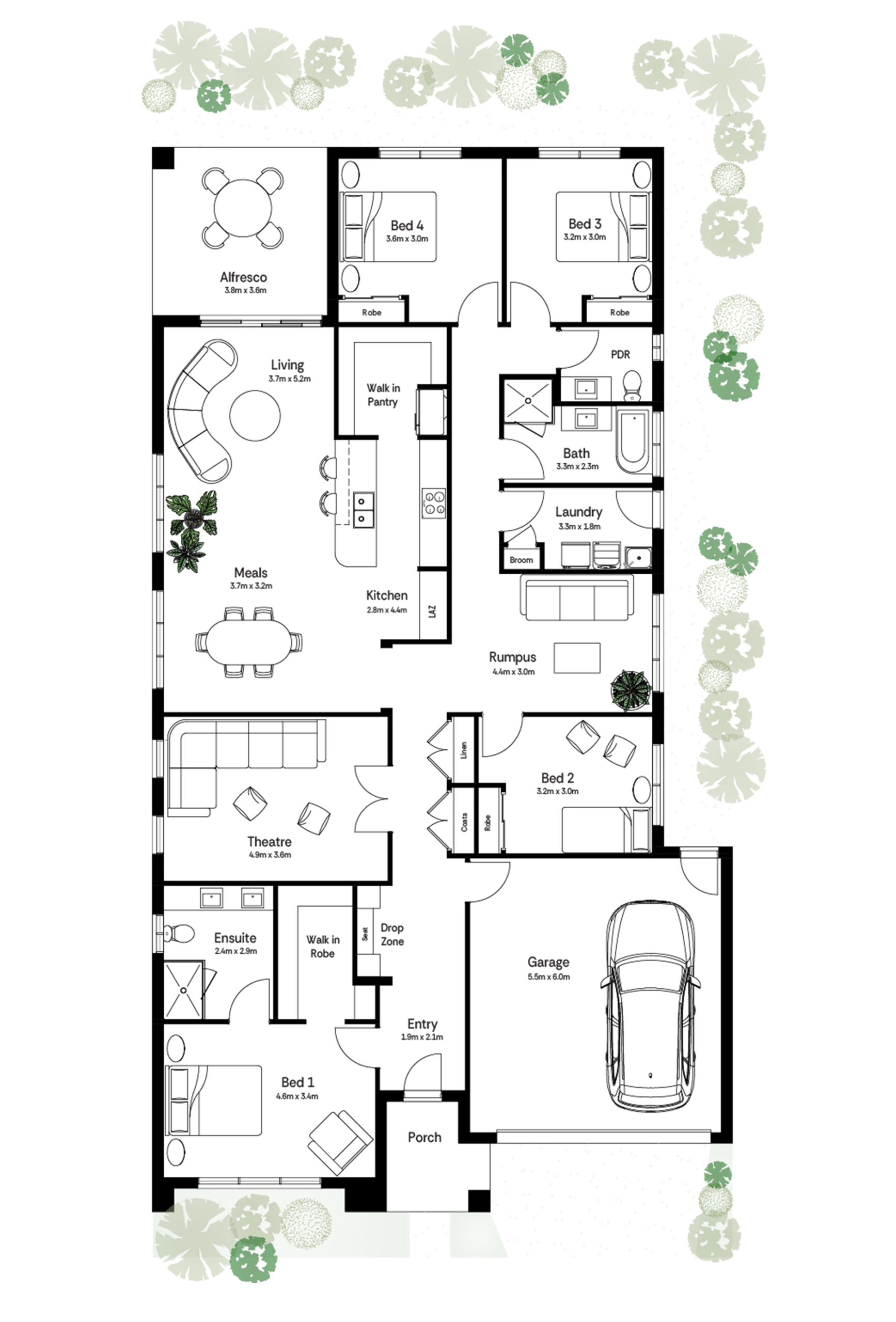

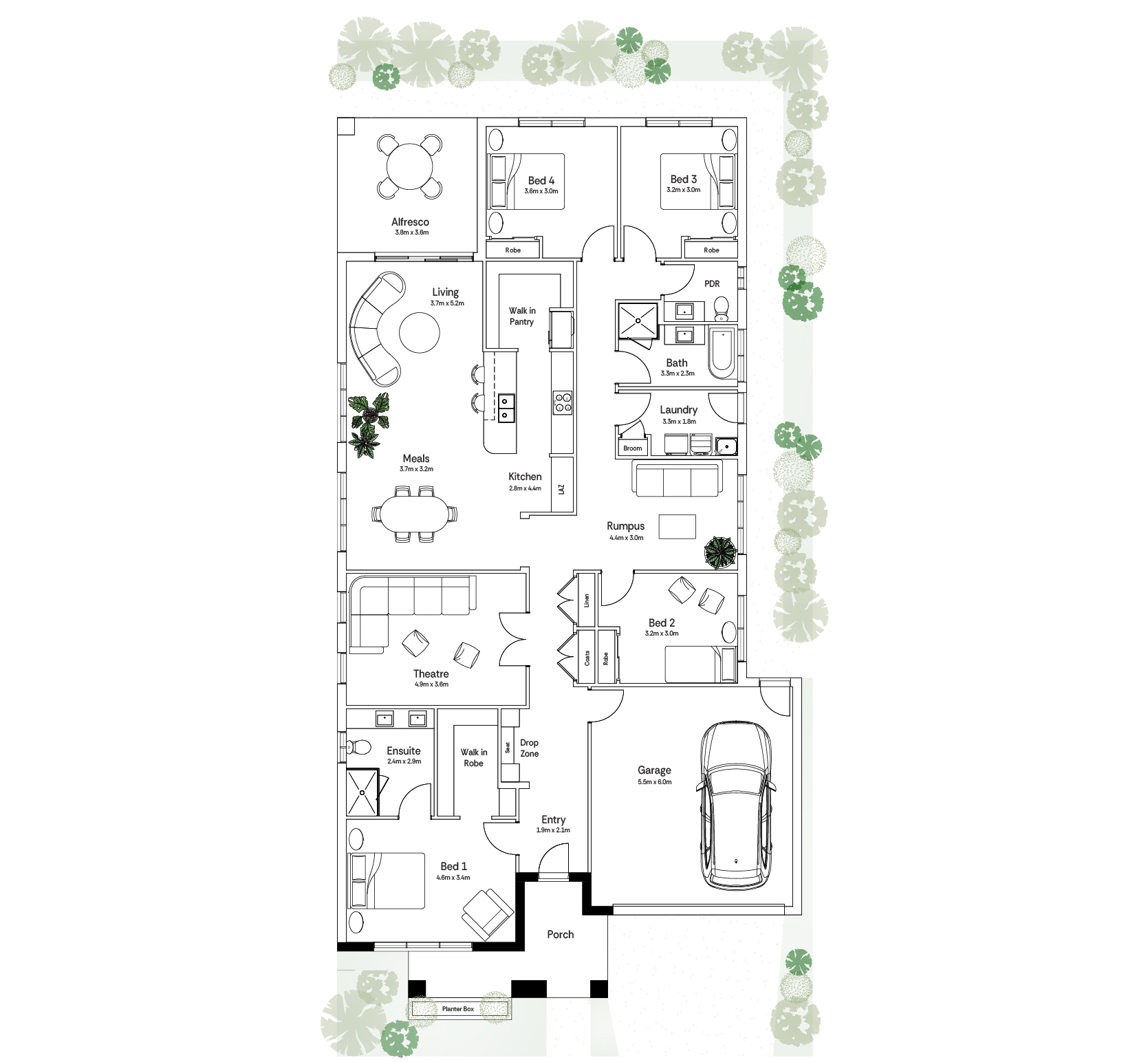

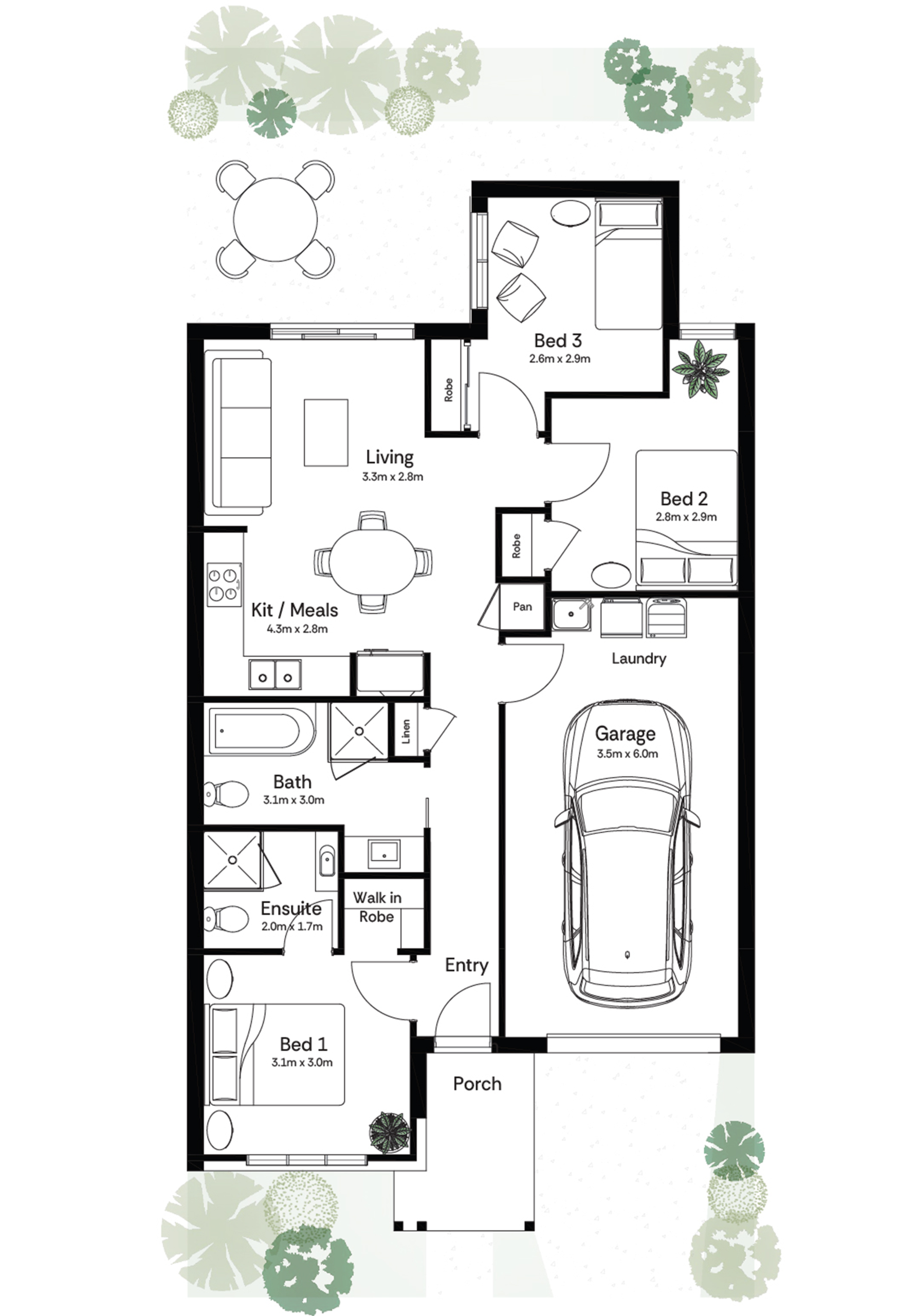

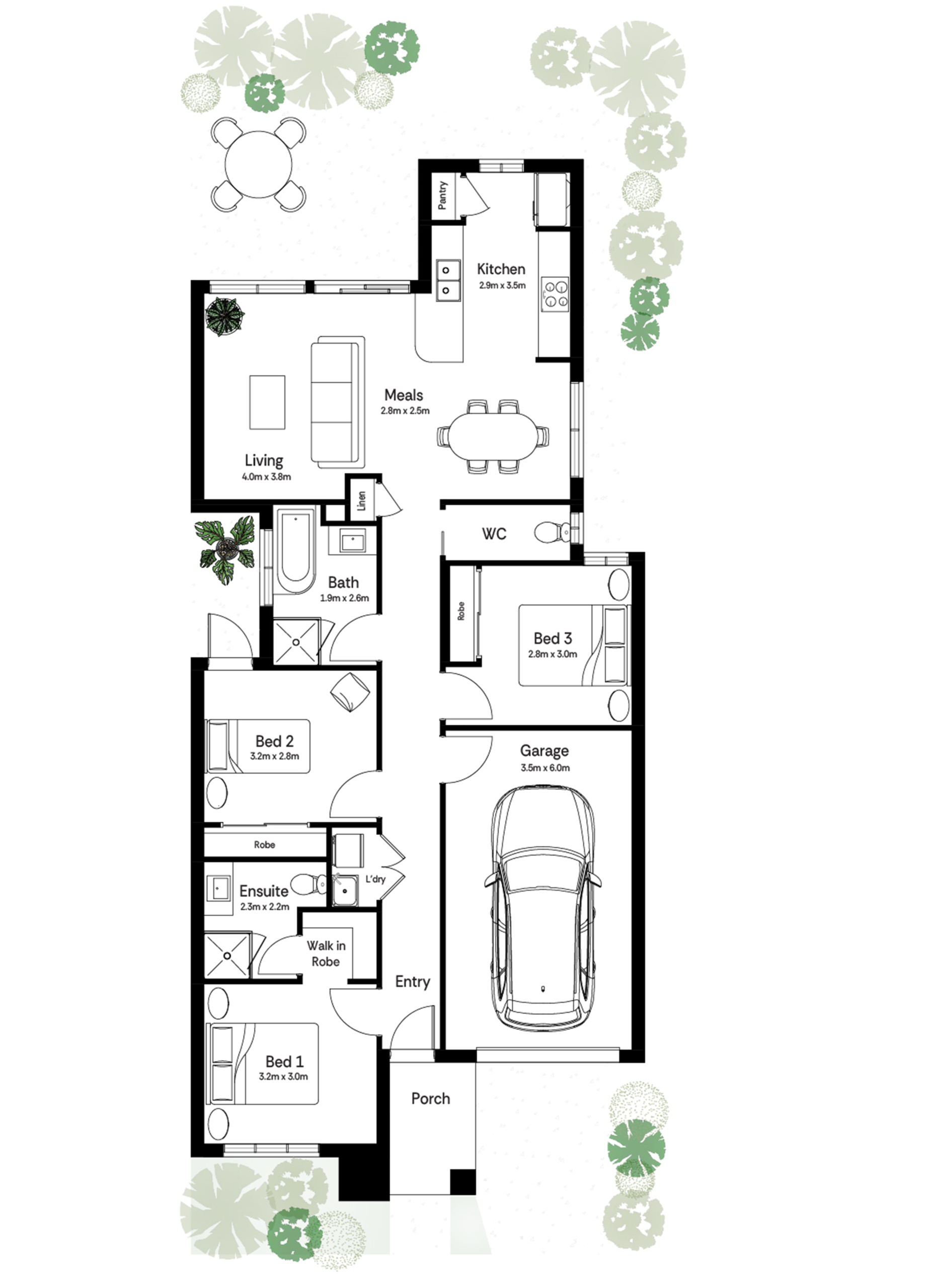

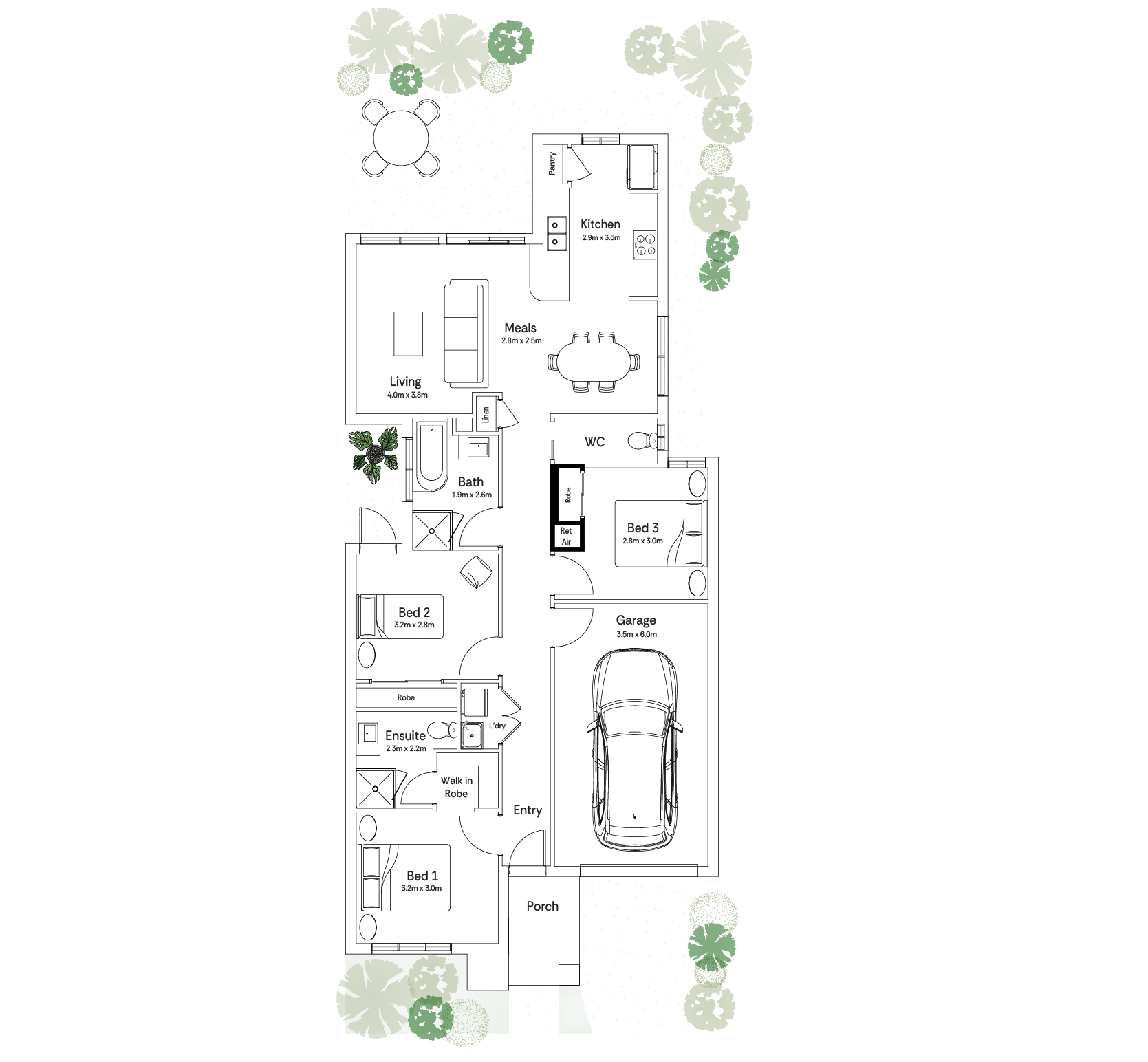

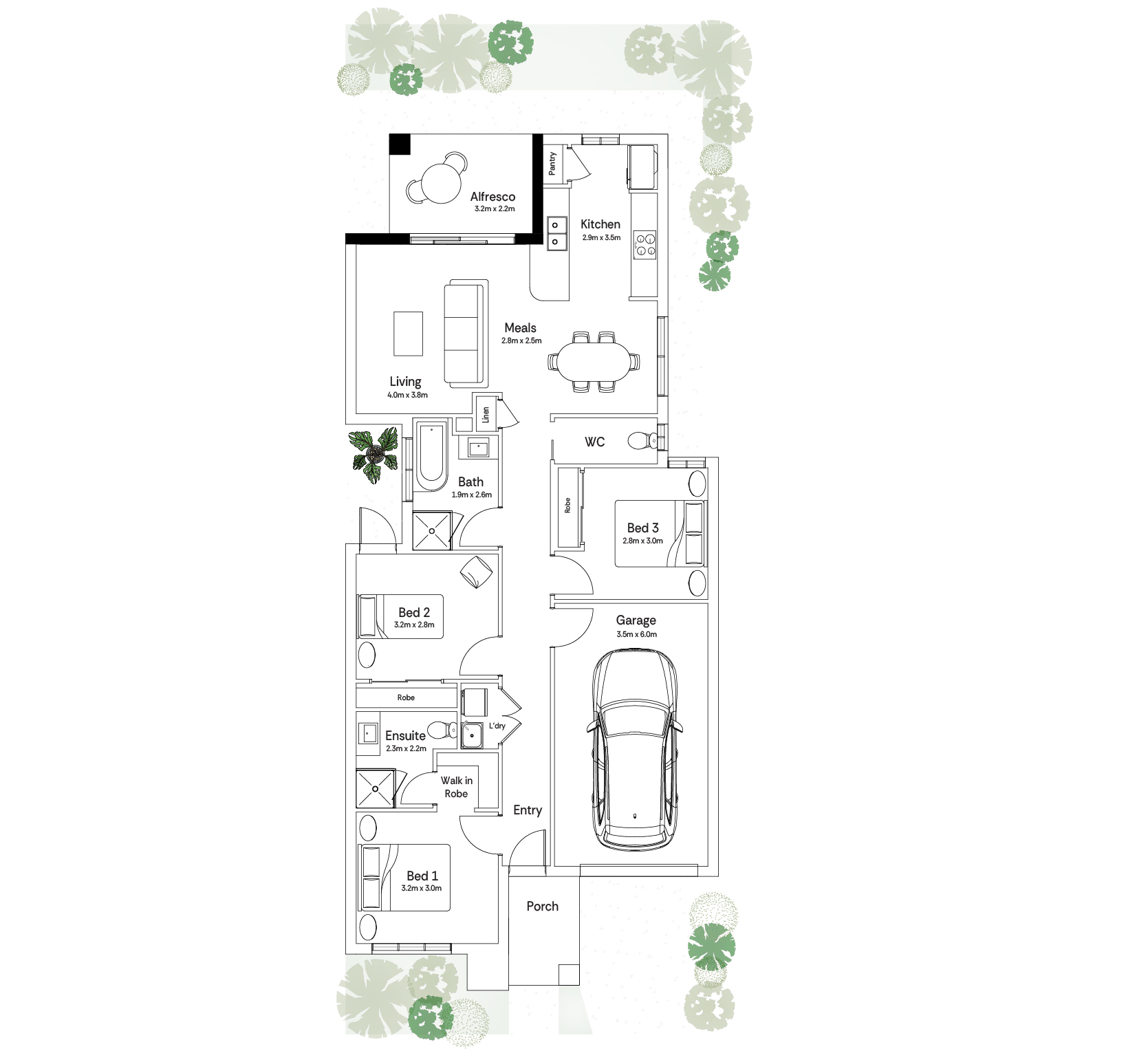

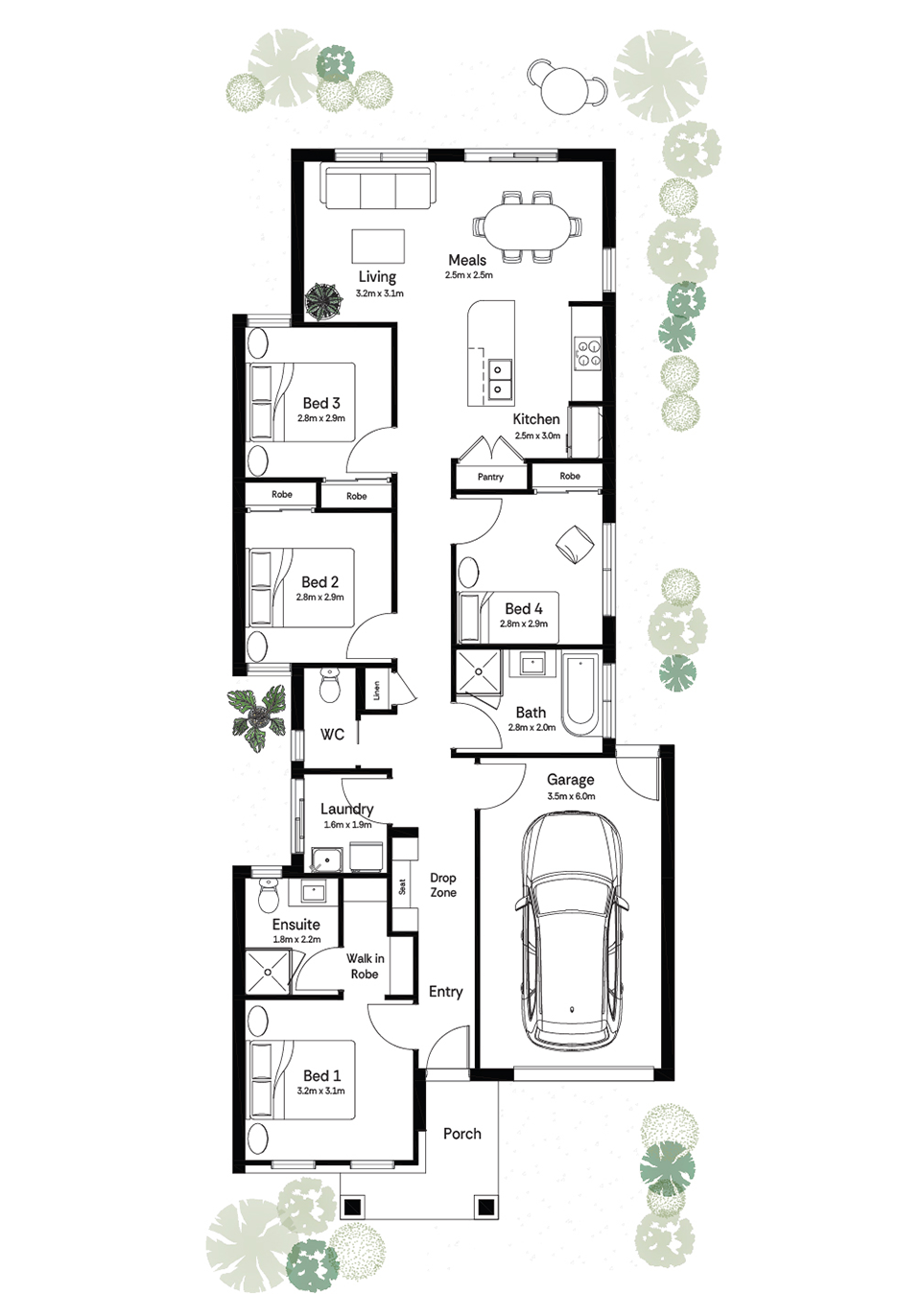

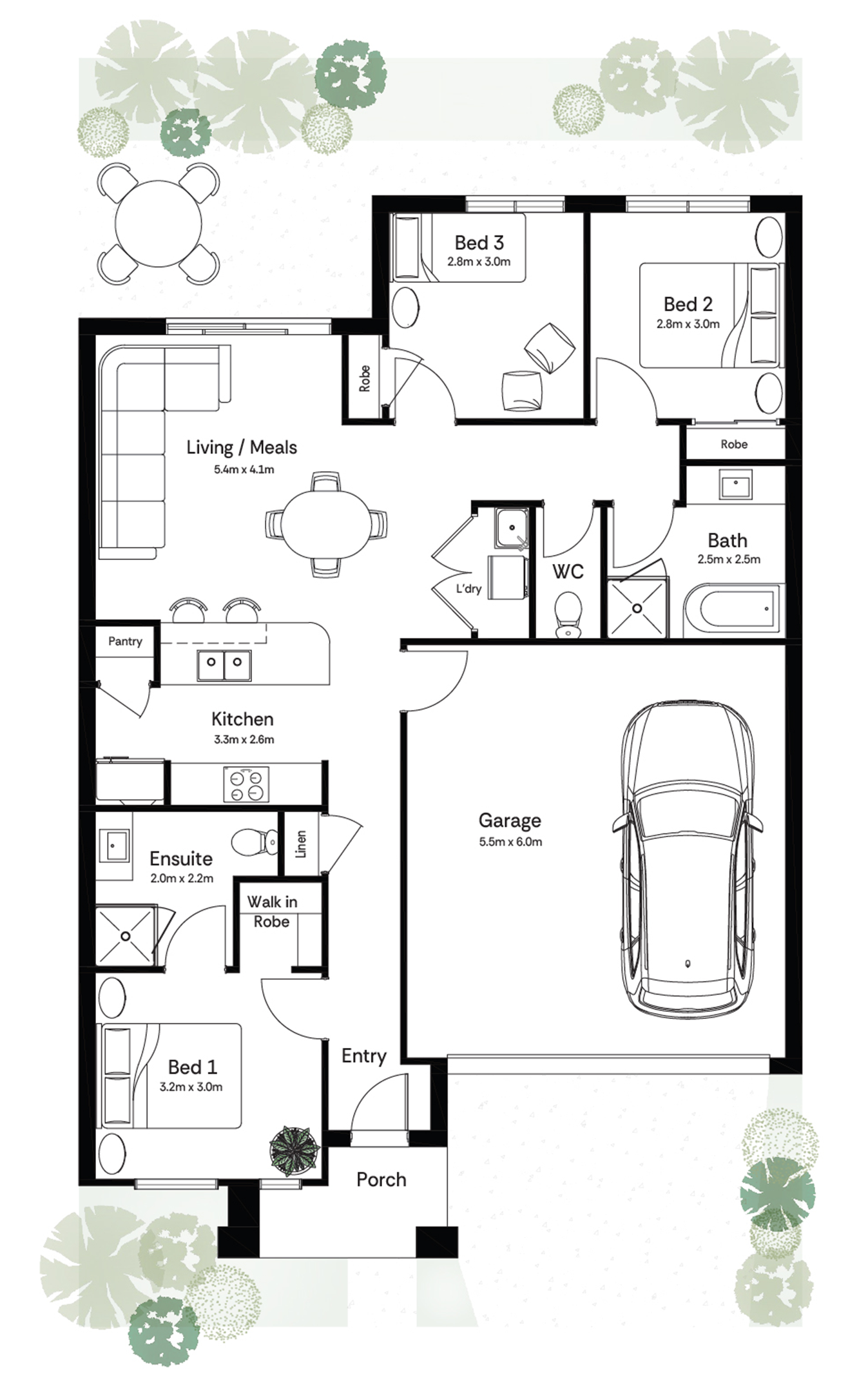

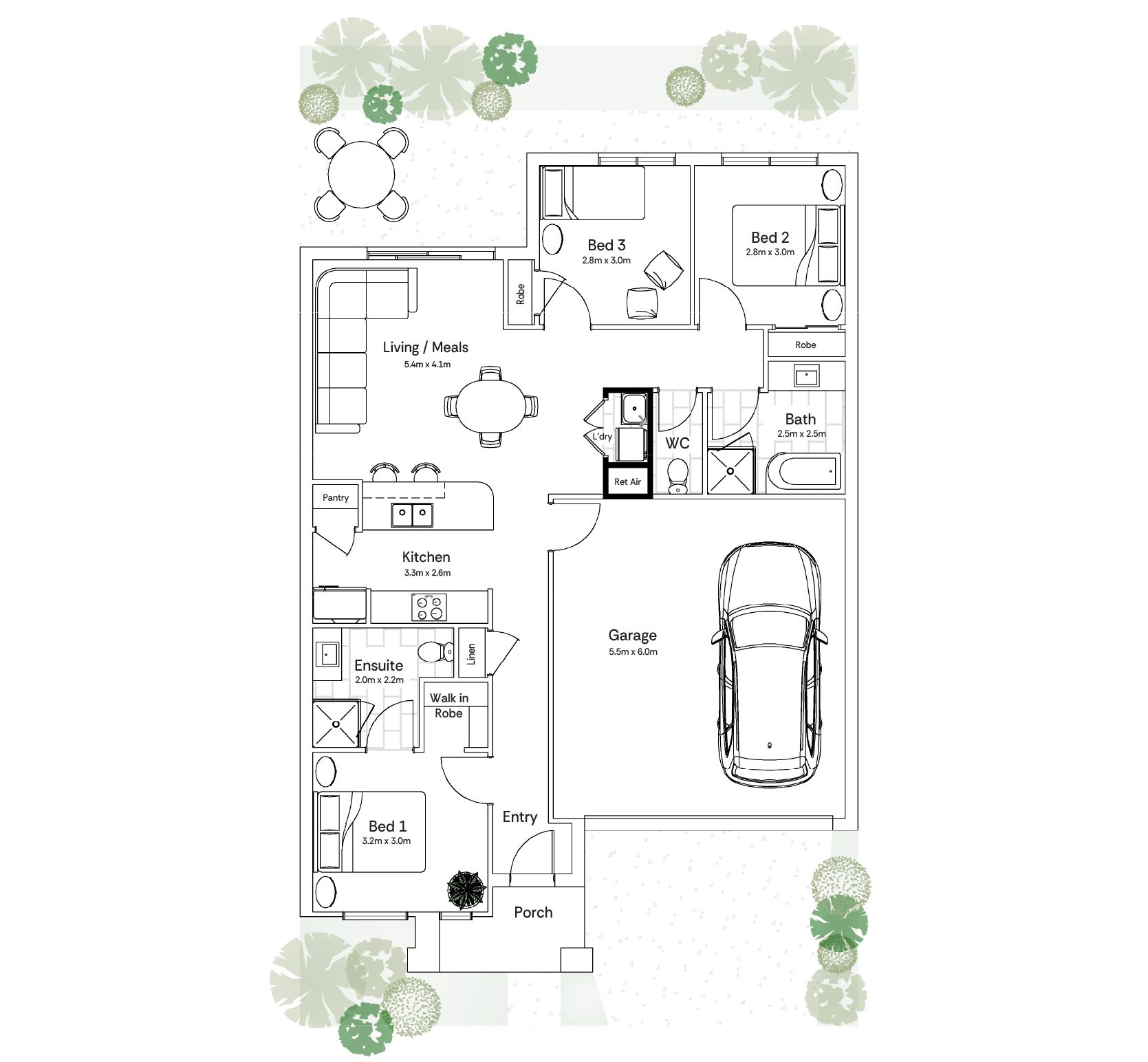

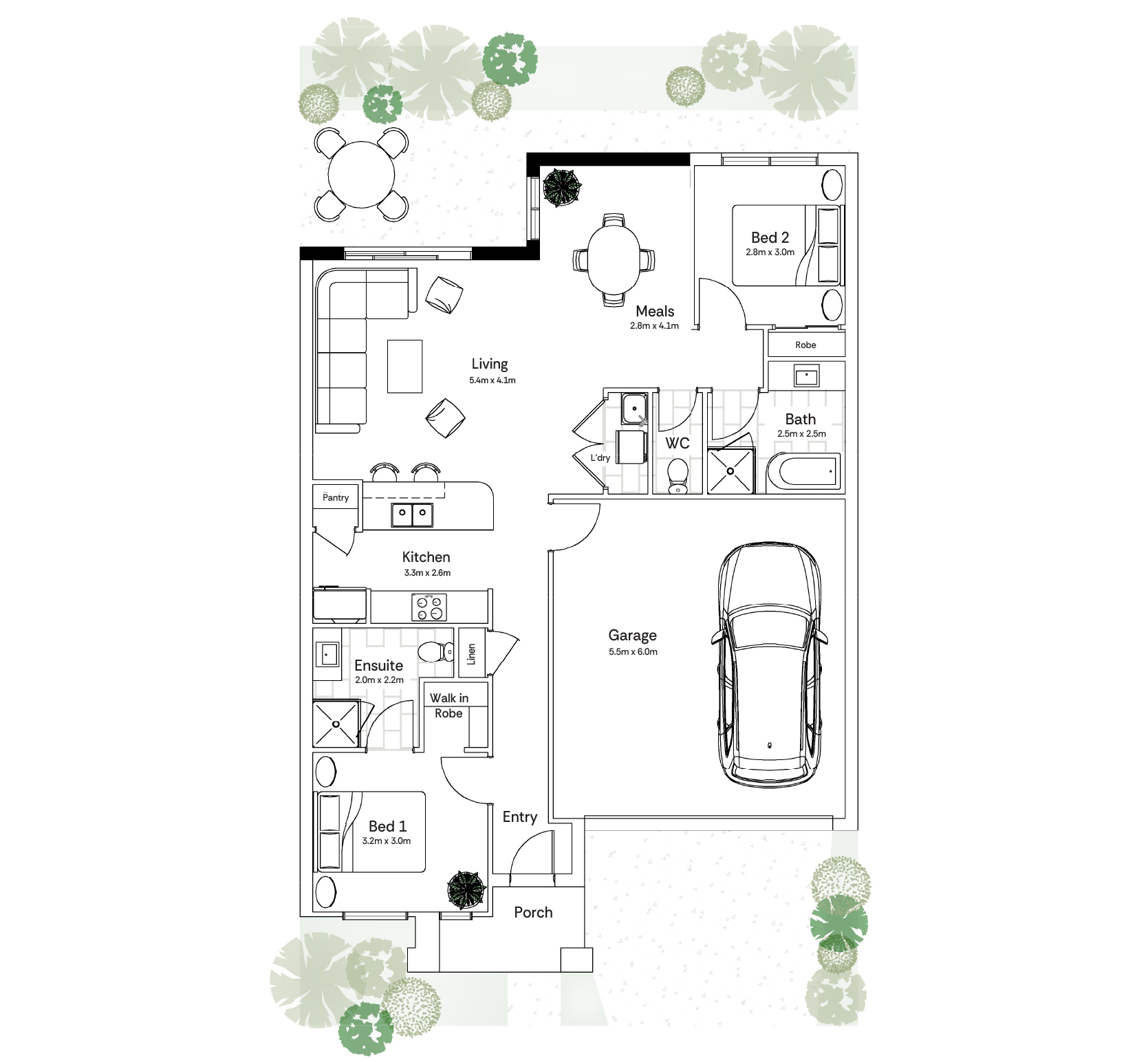

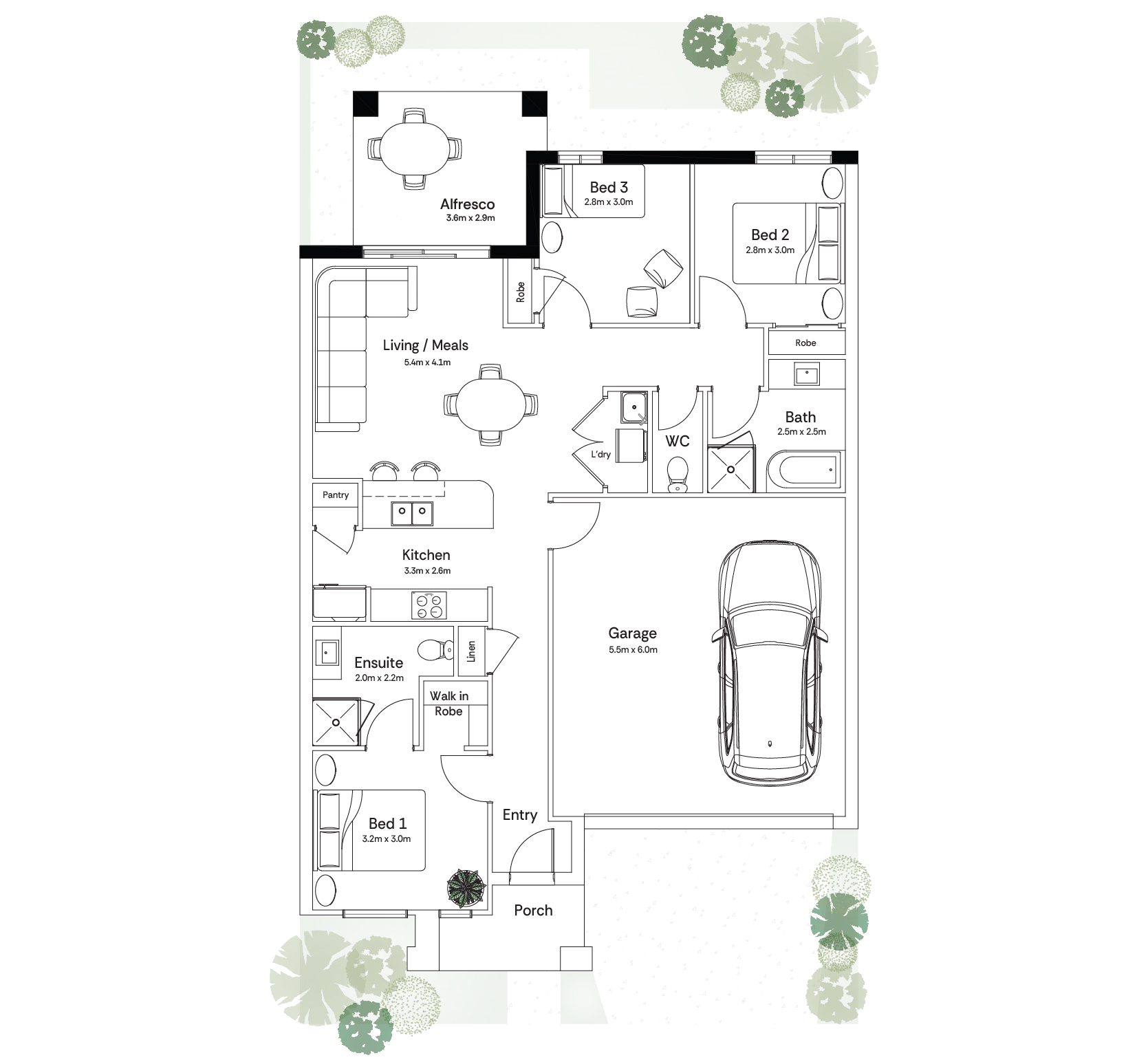

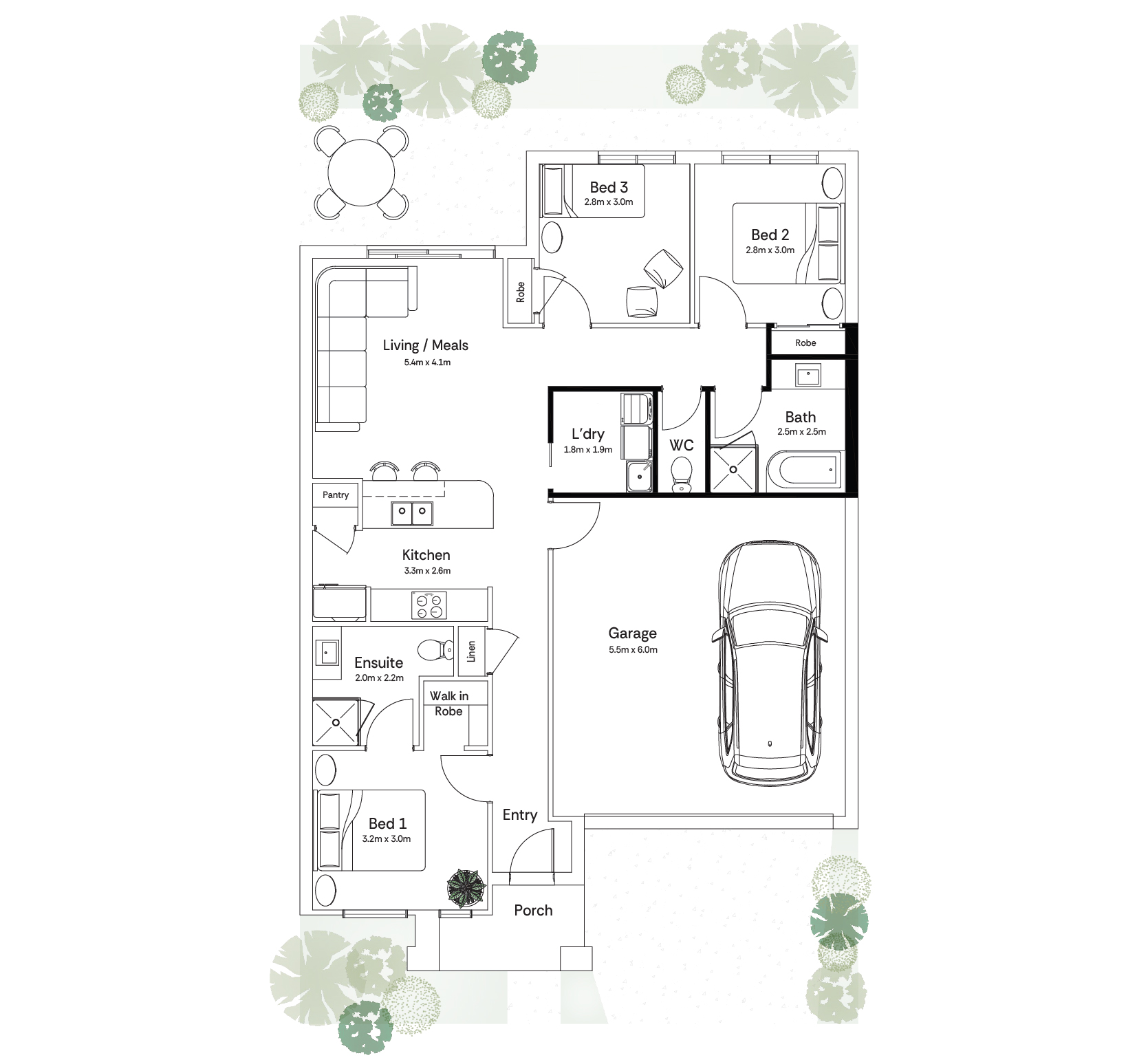

How do I know which home design is right for me?

There are a few things you can consider when choosing a home design:

– Whether kids are on the horizon – if they are, you might want to consider extra bedrooms or a second living room.

– Land size and location – already have land? Your design will need to fit on the block and meet the building requirements of your location (we can help with this!)

– Your non-negotiables – is a butler’s pantry simply a must-have? And a walk-in robe an absolute essential?

– Your budget – there’s a home design for every budget.

Need some guidance? Our sales consultants spend all day helping people figure out the best fit for their vision. Get in touch.

What is a house and land package and how do they work?

A house and land package is a piece of land in a new estate that is matched with a fixed price home that will be built on it.

That means there will be two separate contracts – one with mayde, and one with the developer.

Alongside our leading developers, we can help you find the right land with a home to match. Or if you have the land side of things under control, we can help with just the home.

What does fixed-price contract mean?

This is what we mean when we say there’s no nasty fine print. All the costs are upfront, fixed, unchangeable.

We won’t spring any additional costs on you upon completion of the house and land package, so you can rest easy knowing it’s all sorted.

Does mayde help with deposits and finance?

Absolutely. We’d be more than happy to assist you here, alongside our partners at Charter Private.

Just drop us a message and we’ll be in touch.

What do I need to do to make my home ready to move in?

Other than a shopping spree for new furniture, you’ll also need to set up your utilities (gas and electricity), organise building and contents insurance, and ensure you’re set to begin making loan repayments.

Our finance partners at Charter Private will help you prepare for this final part.

Any other questions? We’re all ears. Send us a message today.